Day trading is all about making quick moves, buying and selling stocks in the span of a single day, aiming to profit from those short-term price changes. But when it comes to picking stocks for day trading, you’ve got a sea of options out there. Deciding which stocks to go for can seem overwhelming at first.

Understanding Day Trading

Day trading is all about making money from the ups and downs in stock prices, all within a single day. Here’s what you need to know:

- Day traders: Day traders look to buy low and sell high on the same day, taking advantage of Volatility in the market to pocket some quick profits.

- Liquidity, Volatility, and Trading volume: When picking stocks for the day, they focus on Liquidity, Volatility, and Trading volume. High Liquidity makes it easy to jump in and out of trades, Volatility shakes up prices enough to make a profit, and lots of Trading volume means lots of interest in the stock, so selling or buying won’t be a hassle.

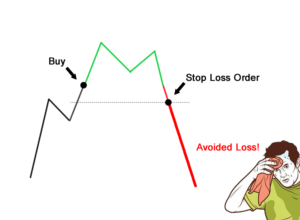

- Risk Management: Since things can move fast and sometimes not in your favour, having a solid plan for managing risks is key. This includes knowing when to cut your losses by using something called Stop-loss orders, which automatically sell off your holdings if things start heading south too quickly.

Criteria for Picking Day Trading Stocks

Liquidity

When you’re looking into how to pick stocks for day trading, knowing about Liquidity is super important. Liquidity just means how easy it is to buy or sell stocks without causing big changes in their prices. Here’s why it matters:

- For Day traders, high Liquidity is a must. It lets you quickly jump in and out of trades at prices you expect, which is key for making the most of those fast, short-term price shifts.

- Look for stocks that people trade a lot every day because they’re usually more liquid. This constant buying and selling action means you’re less likely to run into price tricks and can smoothly start or end your trades.

- Keep in mind that Liquidity isn’t the same all day. It’s often higher when the market opens and closes. Knowing this can help Day traders plan better trades.

By focusing on Liquidity, you’ll face less slippage—that annoying gap between the price you want and what you actually get—and have an easier time sticking to your trading strategies, using technical tools, and managing risks.

Volatility

Volatility is just a fancy way of talking about how much a stock’s price goes up and down over a bit of time. We measure it by looking at how wildly the stock’s price changes.

Now, why should day traders care? Well, high Volatility means a stock’s price can swing pretty big either way in no time. That spells more chances to make money but remember, it also ramps up the risk you’re taking.

- What to Look For: If you’re into day trading, you’d probably want to stick with stocks that have a bit or a lot of Volatility. These stocks move enough in a day that you might snap up some decent profits from those shifts.

- Digging Into the Past: One smart move is to look back at how the stock has done before. Checking out its past price swings helps guess how wiggly it might be in the future. You can use tools like Google Finance or Yahoo Finance for this kind of detective work.

So, when picking stocks for your next day trading adventure, keep an eye on ones with that mid to high Volatility vibe—they’re your ticket to potential profit city. Plus, don’t forget doing your homework by comparing those historical prices; it could really help you spot trends or patterns that mean good news for future Volatility.

Trading volume

Let’s talk about why Trading volume is a big deal, especially if you’re into day trading. Here’s the rundown on why it matters:

- When you see High Trading volume, it means there’s a lot going on with that stock—lots of buying and selling. This usually leads to big price changes, and that’s something Day traders keep an eye out for to make their moves.

- On the other hand, Low Trading volume suggests not much interest in a stock. Prices might not move predictably, making it trickier to buy or sell without compromising on price.

- Ever notice sudden jumps in trade amounts? Those Volume spikes are clues that something new is happening, maybe kicking off a trend or wrapping one up. It’s these moments that Day traders look for to decide when to jump in or bow out.

- Tools like Volume Profile, VWAP (Volume Weighted Average Price), and the Accumulation/Distribution Line help break down where trades are happening and at what prices. This info points Day traders toward where they might want to get in or out.

- By weighing today’s volume against the usual amount, you can get the scoop on how meaningful a price move really is. A big price leap on high volume? That’s likely solid action. But if there’s not much volume behind it, maybe take that price change with a grain of salt.

Adding how you look at volume into your day trading mix can really up your game, helping you spot better opportunities and manage risks like a pro.

Strategies for Identifying Potential Stocks

Scanners and Watchlists

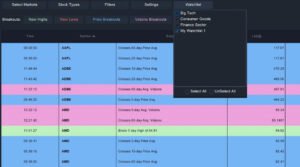

When figuring out how to choose stocks for day trading, using scanners and watchlists is key.

Here’s a straightforward breakdown on making the most of these tools:

- For Day traders who need to make quick decisions, scanners are lifesavers. They keep you in the loop with live updates on stocks that meet your criteria, such as Volatility, changes in volume, and price shifts.

- A watchlist, though, is more like your personal stock wishlist. It’s a list you regularly update with stocks that caught your eye before—for reasons like interesting Sector trends or useful Technical indicators.

Setting Up Your Scanner

Want to set up a scanner? Just follow these easy steps:

- Pick a trading platform known for its powerful scanning tools. ThinkorSwim, TC2000, and OptionStalker are all good choices.

- Adjust the scanner settings to filter for what matters to you—this could be things like an uptick in volume, specific price ranges, or signs of an upward trend.

- Give your scanner a test run while the market’s open to fine-tune it so it really zeroes in on stocks that fit your Day trading strategies.

Utilizing Watchlist

Creating an awesome watchlist involves a few key steps:

- Every day, add stocks that catch your eye—maybe they’re buzzing more than usual, lots of people are buying or selling, or their prices are jumping around.

- Organize your watchlist. You can sort it by things like which industry they’re in, how big the company is, or certain patterns you notice in the stock charts.

- Use alerts for price changes or Technical indicators to keep tabs on when might be a good time to make your move.

For Day traders, having a solid watchlist and scanners ready helps narrow down the stock sea to the most interesting picks quickly.

Together with smart Day trading strategies, digging into Technical analysis, and keeping risks in check, these tips can really up your trading game in the always-busy stock market.

Technical Analysis

Technical analysis is a key tool for anyone into day trading. It’s all about looking at past prices and how much of something was traded to guess where prices might go next. Let’s break down how you can use Technical analysis to up your day trading game:

Using Technical indicators

To find the perfect moments to jump in or out of a trade, Technical indicators are your best friends. Some top choices for day traders include:

- Moving Average Convergence Divergence (MACD): This one helps you see where the trend is heading and when it might flip.

- Relative Strength Index (RSI): It tells you if a stock is being bought or sold too much, hinting at possible price changes.

- Bollinger Bands: These guys help figure out how wild the market might get by showing potential price moves.

Spotting Chart Patterns

Chart patterns are like secret signs that can give you clues about what might happen next in the market. Keep an eye out for:

- Trend Lines: These lines show if the market’s going up, down, or sideways, and when it might change course.

- Channels: They outline the highs and lows of price movements, giving hints on where things are headed.

- Triangles: These indicate whether the current trend will keep going or take a turn.

Understanding Breakouts and Reversals

Understanding breakouts and reversals is huge because they signal big market moves:

- Breakouts: This happens when prices bust through their usual range – either up through resistance or down through support – which might mean a new trend is starting.

- Reversals: These show that the current trend might be about to go backward, opening up chances to hop on a new trend.

Getting good with these parts of Technical analysis helps day traders make smarter decisions fast – which is what you need to win in the quick world of day trading.

News and Events

Knowing what’s happening in the world is key if you’re figuring out how to find stocks to day trade. Big news can shake up stock prices fast, giving Day traders great chances to make some moves. Let’s talk about how you can use news and events in your trading game plan:

Monitoring Economic Calendars

- These calendars are your go-to for keeping track of important stuff like company earnings reports, big economic announcements, and decisions from central banks. All of these can really stir the pot in terms of Volatility.

- You can find these calendars on financial news sites or through your Trading platforms. They’re perfect for planning when to make your trades.

Using News Sources

- Places like Bloomberg, CNBC, and Reuters are where you can get the latest financial news that could push stock prices one way or another.

- Make sure you’ve got alerts set up for any stocks you’re watching. This way, you won’t miss out on news that might open up a good trading opportunity.

Analyzing the Impact of News

- Remember, not every piece of news will toss stock prices around the same way. Sometimes good news will send a stock soaring, while bad news might drag it down.

- Try to get a read on how different bits of news could sway the prices of stocks or entire sectors you’re interested in. This insight lets you guess which way prices might jump and plan out your trades with more confidence.

Using updates on events and breaking stories as part of your strategy is super important when you’re aiming to catch swings in stock prices thanks to Volatility. Keep yourself well-informed and ready to act on what’s happening around the globe, and it’ll give you an edge in snatching up opportunities as they come up in the market.

Entry and Exit Strategies

Having good entry and exit strategies is key in how to find stocks to day trade. You’ll rely on a mix of Technical indicators and chart patterns to figure out the best times to start and end your trades. Let’s break down these strategies:

Technical indicators

- Things like Moving Averages, MACD, and RSI are what we call Technical indicators. They help point out when might be a good time to jump into a trade. For example, if a short-term moving average crosses above a long-term one, it could be your clue to go long.

- To decide when it’s time to say goodbye, you can look at indicators such as the Parabolic SAR or Bollinger Bands. If the price pops out of the upper Bollinger Band, it might mean the stock’s getting too pricey, signaling an exit.

Chart Patterns

- Keep an eye out for chart patterns that hint at good entry points like cup and handle or head and shoulders.

- On the flip side, patterns like double tops or bottoms can tell you when it’s time to get out before a potential downturn.

Stop-loss orders

- Using Stop-loss orders lets you set a price where your stock will automatically sell off, helping cut your losses.

- Trailing Stop-loss orders are cool because they let your winnings run while still having a safety net if things turn south by closing your position if the stock moves against you by a certain amount.

Profit Targets

- Decide on clear profit targets using old support and resistance levels or choose based on how much risk you’re willing to take versus potential reward.

- Thinking about exiting partially at various profit points means snagging some gains while leaving room for more if the stock keeps going up.

For Day traders, planning how you’ll get in and out of trades is crucial for controlling risk and taking advantage of gains. Always keep testing and tweaking these strategies so they fit with both your trading style and how the market’s moving.

Conclusion

Wrapping it up, figuring out how to pick stocks to day trade isn’t just about one magic tip. It’s about:

- Getting the hang of why Liquidity, Volatility, and Trading volume are key.

- Using tools like scanners and watchlists to spot which stocks might be worth a closer look.

- Leaning on Technical analysis for clues on price moves and patterns that matter.

- Keeping up with any news or events that might shake up stock prices.

- Making sure you’ve got smart plans for when to jump in and out, using things like Stop-loss orders to keep the risks in check.

Day trading takes a lot of discipline, a solid understanding of how the market ticks, and the right set of tools to stay on top of things. Stick to these guidelines and keep sharpening your approach, and you’ll boost your chances of doing well in the fast-paced world of day trading.