When looking at how to pick stocks for long-term investment, you’ve got to think differently. Here, it’s not about quick wins. Instead, it’s about finding companies that have what it takes to grow and succeed way down the line.

Choosing stocks for the long haul is a mix of smart analysis, patience, and spotting both market trends and solid company basics. You’ll need to look into how financially healthy a company is, its edge over competitors (competitive advantages), and how well it might do in future economies.

This guide will cover the key points and strategies you need when picking out a company for your long-term investment game plan.

Understanding the Basics

Starting with a strong foundation is key when researching how to choose stocks for long-term investment. This means knowing what you want out of your investments, how much risk you can handle, and how long you’re willing to wait. These factors are super important because they help decide which stocks will make it into your portfolio.

- Investment Goals: First things first, figure out why you’re investing. Is it for retirement savings, your kid’s college fund, or just building wealth? What you’re aiming for will guide which stocks catch your eye. If you’re all about Long-Term Growth, love getting dividends, or are focused on keeping risks low, your goals will point you in the right direction.

- Risk Tolerance: How do you feel about the ups and downs of the market? If big swings make your stomach turn, high-volatility stocks might not be for you. But if you can ride through the storms without blinking an eye, those same stocks could offer big payoffs. Knowing where your comfort level lies helps build a portfolio that won’t keep you up at night when things get bumpy.

- Time Horizon: Think about when you’ll need your investment back. The longer you can leave it be, the more chance there is for it to grow thanks to compounding returns. Plus, having time on your side means not sweating the small stuff (like short-term drops in value). Keeping an eye on financial health and market trends becomes more about playing the long game than quick wins.

Getting these basics down sets you up nicely to take on the stock market with confidence. It’s all about making choices that align with what’s important to YOU in the long run.

Key Strategies for Stock Selection

Picking the right stocks for the long haul is a game of balancing careful analysis with smart strategy. It’s all about spotting companies that are not only financially strong but also have that edge, like earnings growth and solid financial health, plus a clear competitive advantage.

Focus on Fundamentals

When deciding on a stock for the long term, honing in on a company’s basics is where it’s at. This includes going into detail about their financial health and what sets them apart from competitors, which ensures they’re set for growth in the long run. Here’s what to keep an eye on:

- Earnings Growth: Hunt for companies that have shown they can consistently increase their earnings. This often means they’ve got a solid business model and there’s demand for what they’re selling.

- Financial Health: Take a close look at their finances – good cash flow, not too much debt, and profits are looking healthy. Basically, you want to see that they’ve got a strong financial foundation which will help them stick through tough times and seize opportunities to grow.

- Competitive Advantage: Look for businesses that stand out because of something unique– maybe it’s cutting-edge tech, brilliant branding, legal protections or they’ve just built up an incredible network. These are signs they’ve got something others don’t which helps keep them ahead of the pack.

Mixing these fundamental checks into your investment strategy seriously boosts your chances of picking stocks that will grow over time, helping you meet your investment aims while matching your risk comfort zone.

Dividend Consistency

When planning your long-term investment journey, knowing how to choose stocks for long-term is key. A big part of this is looking at dividend consistency. This means picking companies that not only pay dividends regularly but also aim to increase them over time.

These firms are usually seen as financially solid and serious about giving back to their shareholders. That’s a good sign if you’re aiming for long-term growth and want some income on the side.

- Dividend Yield: When hunting for these stocks, keep an eye on the dividend yield. It shows you the dividend compared to the stock price as a percentage. Sure, a high yield might grab your attention, but it’s important to check if it’s actually sustainable or just a warning sign of trouble ahead.

- Dividend Growth: Firms that boost their dividends regularly are often in great shape financially and optimistic about their earnings’ future. This kind of growth isn’t just about showing confidence; it also helps your investments grow through compounding over time.

Evaluate Economic and Industry Trends

When choosing stocks for long term, it’s extremely essential to look at the big picture. This means checking out the economy and industry trends that could affect the sectors and companies you’re eyeing.

Economic Indicators

- GDP Growth: If the GDP is growing nicely, it usually means we’ve got a strong economy. This is often good news for stocks.

- Interest Rates: When interest rates change, they mess with borrowing costs and how much people spend. This can make a difference in how well companies do and, in turn, their stock prices.

- Inflation: High inflation can reduce how much consumers buy and squeeze company profits. This impacts how much stocks are worth.

Industry Trends

- Technological Advancements: Companies that get ahead by using or creating new technology might grow faster than others.

- Demographic Shifts: If more people need something (because of age changes or other reasons), companies meeting those needs might see a boom.

- Regulatory Changes: Sometimes new laws or rules can help or hurt industries. Stocks in these areas could go up or down as a result.

By keeping tabs on these economic factors and industry shifts, you can aim for better picks for your portfolio focused on long-term growth. Remember, what happens around the world can also impact markets everywhere, so staying updated on global developments is essential as well.

Mixing Up Your Stock Analysis

When deciding how to choose stocks for long-term investments, it’s a good idea to use a variety of analyses. This means looking at the numbers, checking out stock price patterns, and even thinking about stuff like how good a company’s management is. Let’s break it down:

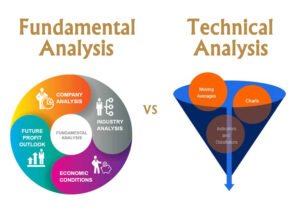

Fundamental Analysis

In fundamental analysis, we look to see if a company is financially stable. We’re talking about things like whether a company is making more money than before (earnings growth), if it’s in good financial shape (financial health), and how well it can keep ahead of its competitors (competitive advantage). It helps spot companies that might do well in the long run.

Technical Analysis

Technical analysis looks at how stock prices move and how many shares people are buying or selling. It’s usually for short-term stuff, but some of these tricks can also help you figure out the best times to buy or sell, even if you’re thinking long-term.

Qualitative Analysis

Qualitative analysis is concerned with things that cannot be quantified – like how strong a company’s brand is, its place in the industry, or if it has a solid management team. These things are extremely significant because they can mean a company has what it takes to grow and succeed down the line.

Mixing all these analyses together gives you a much clearer picture. You get the hard facts from fundamental and technical analysis, but also get to understand what makes each company unique through qualitative analysis. This way, your choices are well-rounded and fit your goals.

Diversification

Learning how to choose stocks for long-term success is all about understanding diversification. Think of it as not putting all your eggs in one basket. Instead, you spread your investments across different sectors and industries. Because it helps you to dodge big losses if one area of your business fails.

Mixing up your stocks softens the impact of market ups and downs, making sure no single trend can wreck your whole portfolio. A varied mix of stocks means you’re better prepared to handle whatever the economy throws at you, aiming for consistent long-term growth.

Keeping Your Portfolio on Track

It’s important to remain competitive when determining how to pick stocks for long-term. You’ve got to keep an eye on your investments and tweak them as needed to stay aligned with your goals and how much risk you’re willing to take.

- Checking Up: It’s smart to regularly review how your investments are performing. This check-in allows you to see if everything is going toward your long-term goals. Each stock’s place in your strategy needs a lookover too, especially with shifting market trends and new economic indicators.

- Balancing Act: Sometimes, some parts of your portfolio might do really well while others don’t. This can disrupt the balance you started with. So, rebalancing is where you adjust things back to your preferred setup. It’s like keeping all parts of the boat evenly weighted so it doesn’t tip over which is essential for controlling risk and avoiding putting too much into one area.

- Keeping Up With News: Staying informed about what’s happening in the financial world and within the companies you invest in makes a huge difference. Watch out for changes in things like earnings growth, dividend yield, or shifts in their overall business health or edge over competitors. Knowing what’s going on helps you to make smart decisions quickly, grabbing new opportunities or avoiding risks.

By doing these reviews, rebalancing when necessary, and staying informed about financial news, investors can manage their portfolios with agility—navigating through market changes and personal life shifts alike toward achieving solid Long-Term growth while keeping risks at bay.

Conclusion

Wrapping things up, choosing stocks for long-term investment is a bit of an art form that needs patience and a methodical approach. Here’s what you should keep in mind:

- Set clear goals and know how much risk you can handle.

- Bet on companies with solid backgrounds, looking into earnings growth and financial health.

- Regular dividends are a positive indicator of a company’s steady performance.

- Keep tabs on economic indicators and industry trends to spot where growth is happening.

- Don’t just stick to one way of analyzing; mix it up with fundamental, technical, and qualitative analysis.

- Spread out your investments (diversification) to reduce risk.

The goal of this guide is to provide you with a solid starting point for picking stocks that are likely to pay off in the long run, by blending long-term growth, smart risk management, and careful portfolio diversification.

Though we’ve been talking about long-term investing, these insights are also handy if you’re considering day trading – just keep in mind that the game is faster and riskier there. Remember, acing long-term investments means sticking to your strategy, regularly checking your portfolio, and being flexible with market shifts.