Stocks, also called equities or shares, represent ownership in a company. When you purchase a stock, you buy a small part of that company. Investing in stocks lets regular people participate in business growth and success. It also gives companies a way to raise money.

Knowing about different types of stocks is very important for investors to make better trading decisions.

This article introduces main stock types briefly, including common and preferred stocks, share classes, cyclical and defensive stocks, growth and value stocks, and penny stocks. Grasping the basic features and differences between types of stocks helps investors better deal with the market and make smarter investment picks.

Common and Preferred Stocks

With investing in stocks, it’s key to know the differences between two major types: common stock and preferred stock. Each type offers unique upsides and downsides for investors.

Definition and Basics Differences

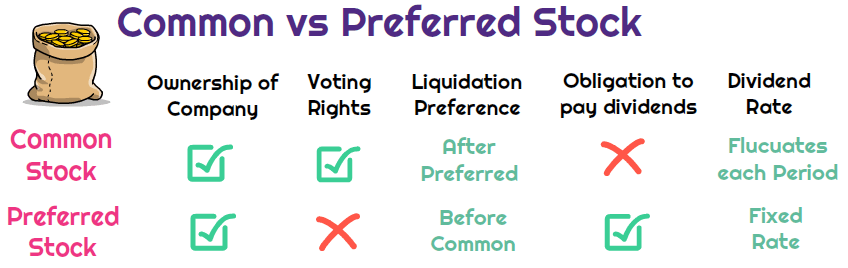

- Common stock means owning part of a company, often with voting rights. Holders can benefit from company growth and profits through potentially higher stock prices and dividends (if a company pays them).

- Preferred stock usually does not come with voting rights but promises fixed dividend payments. Preferred shareholders have first priority over assets and earnings over common shareholders, giving more stability.

The big differences come down to ownership rights and money benefits. Common shareholders can earn higher returns from rising stock value and dividends but take on more risk too. Preferred shareholders get predictable income and senior claims on assets but give up capital growth potential.

Common vs Preferred Stocks: Dividends and Voting Rights

Common and preferred shareholders get different rights for dividends and voting.

- Common stockholders can receive dividends, but payouts depend on profits and board decisions- not guaranteed.

- Preferred shareholders instead get fixed dividends paid at regular intervals, often at higher rates than common stock.

Regarding voting, common stockholders usually vote on company matters like electing the board and big policies. Their voting power depends on how many shares they own.

Preferred stockholders generally don’t vote, although exceptions happen.

Common vs Preferred Stocks: Risks and Returns

These two stock types have different risks and returns.

- Common stocks take more risk but offer possible higher returns through stock price gains and dividend growth. They fluctuate more with market swings.

- Preferred stocks give more stable and predictable returns through their fixed dividends, but don’t gain in value much.

Investors with higher risk tolerance and long horizons might prefer common shares. While those wanting steady income and less risk might go with preferred.

Classes of Stocks: A, B, C Shares

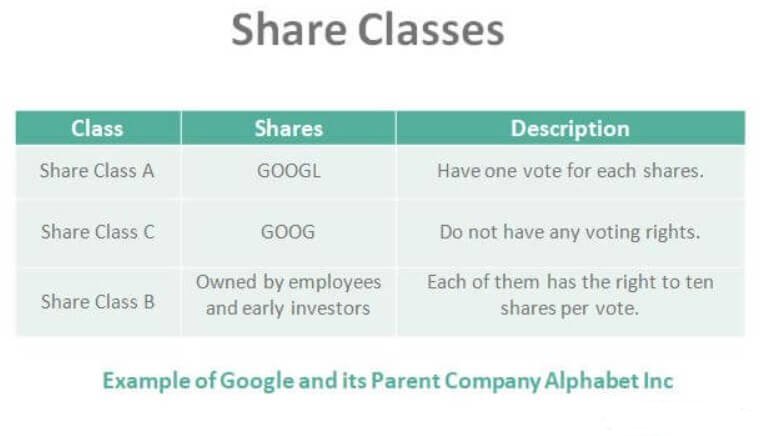

Along with common and preferred shares, companies can split up their stock even more into share classes – usually Class A, Class B and Class C. These classes get different rights and benefits, like special voting abilities, dividend rates and ownership limits.

What Share Classes Mean

Class A, B and C stocks categorize a company’s shares with distinct privileges. Firms make these classes to keep control over big choices while appealing to different investors.

Class A often has the most voting power, while Class B might have less or zero voting rights but offer other benefits like bigger dividends. Class C typically lacks voting ability and can get reserved for insiders or public buyers with special limits.

Launching separate share classes ensures that founders, executives and key shareholders maintain control even if they own fewer total shares.

Voting and Dividends Vary

- The classes frequently differ in voting impact and dividend money. Class A usually gets one vote per share to have a voice on company issues like electing the board or approving major moves. Class B might carry fewer votes or none at all. Class C generally has zero voting rights.

- On dividends, Class A normally gets the regular payouts. But Class B or preferred could score higher dividends as a privilege. Sometimes certain classes only get dividends in special cases or don’t qualify at all.

Things to Consider when Investing in Share Classes

When picking between stock classes, investors should weigh several factors.

First, check the voting rights each class carries and decide how much control and power you want.

Next, evaluate dividend rates and potential returns being offered per class.

Investors should also factor the liquidity and trading volume per class, since some have limited marketability. And review any ownership limits or transfer rules applying to certain classes too.

It’s essential to match the traits of each stock class to your goals, risk appetite and desired involvement in company decisions.

Real Company Examples

Some big name firms issue multiple stock classes with differing voter rights and ownership structures. For instance:

- Alphabet has Class A shares (GOOGL) with 1 vote each, Class B with 10 votes each and no-vote Class C shares (GOOG).

- Berkshire Hathaway’s classes differ too – Class A shares cost far more but carry more voting power than Class B.

Launching separate stock classes allows these companies to maintain control while still inviting public investors.

Stock class setups can profoundly influence company control dynamics and investor influence. In some cases, founders or insiders with super-charged shares maintain control even while owning a minority total stake.

Cyclical and Defensive Stocks

When putting together a diverse stock portfolio, you need to know the different types of stocks and how they react to economic conditions. Two key categories are cyclical and defensive stocks.

What are Cyclical and Defensive Stocks

- Cyclical stocks come from companies that closely follow the overall economy. They tend to do well when the economy grows but can struggle when things decline. You often see cyclical stocks in consumer discretionary, industrials and technology.

- Defensive stocks hold up better when the economy fluctuates. They represent essential businesses like consumer staples, healthcare and utilities. People keep buying their products and services even during downturns.

For a balanced portfolio that endures different economies, understanding both stock types are very critical.

Market Behavior

- When the economy grows, cyclical stocks thrive since customers and businesses spend and invest more. But they may slow down when demand falls during declines.

- Meanwhile, defensive stocks offer more stability when things go down as people stick to essentials. These stocks don’t follow the economy as closely, so they offer protection when markets struggle.

Investing in Cyclical and Defensive Stocks

When investing in these stocks, you need to look at economic forecasts and change your strategies. If the economy looks good, put more of your portfolio into cyclical stocks since they tend to beat defensive stocks when things are growing.

Flip that when a downturn seems ahead. Focus instead on defensive stocks that hold steadier through recessions. Having both stock types helps balance risk and returns.

Also factor your risk appetite and goals when deciding how much of each stock to hold. Regularly reviewing and rebalancing ensures your investments match the economy and objectives.

Comparing Risk and Returns

The stocks differ in risk and returns. Cyclical stocks can earn great returns during expansions but carry higher risk from following the economy. You may see big losses when economy decline.

Meanwhile defensive stocks provide lower but more stable returns regardless of cycles. They likely won’t grow as much during good times but endure during declining economy.

Growth vs Value Stocks

When investing in stocks, two main approaches are growth and value investing. While both aim for returns, they focus on different types of companies.

Characteristics of Growth and Value Stocks

Growth stocks come from fast-growing companies, expanding way above average market rates. These tend to have unique advantages like loyal customers or innovative offerings that encourage high growth potential. To fuel more expansion, they often reinvest earnings instead of dividends.

Meanwhile, value stocks seem underpriced to the market. They usually have lower price-to-earnings ratios and higher dividend yields than market norms. Value investors believe the market misprices them and their true value will eventually emerge and appreciate.

While growth stocks can earn higher capital gains, their high valuations and sensitivity to investor opinions make them riskier. And although considered safer, value stocks may not gain as much as expected or take longer to do so.

Performance Metrics

When reviewing stocks, investors use certain metrics to gauge potential. For growth stocks, key indicators are revenue growth rate, showing rising sales over time and earnings per share growth, reflecting profitability.

Return on equity metric also matters – it measures how well a company generates profits from shareholder investment. Higher return on equity signals strong management and competitive edges.

For value stocks, the key metric is the price-to-earnings ratio (P/E ratio). It compares a share price to earnings per share. A lower ratio can mean an undervalued stock. Higher ratios indicate expected growth is already priced in.

Free cash flow is also very important for both types of stocks. Free cash flow means cash left over after capital spending for potential dividends, buybacks or reinvestment.

Investor Goals Guide Stock Choices

Investor profiles play a big role in deciding which stocks suit their goals and risk tolerance. Growth investors tend to pick high potential technology stocks and accept higher risk for bigger possible returns.

Value investors focus on undervalued stocks with strong basics for steady, long-term gains. Value investors care most about consistent dividends over growth.

Conservative investors might prefer defensive stocks that resist market swings, often in sectors like consumer staples and utilities. Overall, knowing your investor profile helps choose the right stocks to match financial aims and risk appetite.

Penny Stocks and Their Risks

Penny stocks, also called micro-cap or small-cap stocks, are a unique and often misunderstood type of stock. While they offer high return potential, they bring substantial risks that investors need to know before buying them.

What They Are

Penny stocks typically trade under $5 per share from small or new companies. They tend to get bought and sold over-the-counter through the OTC Bulletin Board or pink sheets instead of major exchanges like the NYSE or NASDAQ.

Common traits are low market cap, limited liquidity and high volatility. They also tend to come from companies with little operating history, uncertain finances and little oversight.

The Big Risks With Penny Stocks

Investing in penny stocks carries some huge risks that investors need to know about.

One big risk is the serious lack of reliable financial information. Many penny stock companies don’t have to file reports with the SEC. This makes it really tough for investors to evaluate how these companies are actually doing and their potential.

Another major risk comes from the potential for fraud and manipulation. Penny stocks often attract shady people running “pump and dump” schemes. They artificially inflate the stock price using false information and hype. Then they sell their shares at a profit, leaving regular investors holding worthless stock.

Penny stocks also tend to lack liquidity. This means there may not be many buyers or sellers out there, so trading shares at a desired price or time becomes difficult. This liquidity issue can lead to giant losses for investors if they can’t sell their shares when needed.

It is very important that investors know these big risks about penny stocks before investing. The potential for huge financial losses is much higher compared to more established companies.

Tips for Investing in Penny Stocks

If you are considering penny stocks, be smart and do thorough research. Here are some tips:

- Look thoroughly into the company, management and financials. Be suspicious of limited or unaudited financial information.

- Appreciate the risks like high volatility, low liquidity and fraud potential.

- Set realistic expectations and limit investment to what you can lose. Penny stocks should be a small part of a diverse portfolio.

- Use limit orders when trading to protect from sudden price swings.

Safe Investment Practices

To lower risks when investing in penny stocks or other shares, think about these safe investment moves:

- Diversify your portfolio across different industries, company sizes and geographic areas to spread out risk.

- Use respected brokers and trading platforms that have strong security protections and investor safety nets.

- Stay in the loop on market trends, regulation changes and company news that could impact your investments.

- Set stop-loss orders to automatically sell shares if the price dips too low, limiting potential losses.

- Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

Domestic vs International Stocks

Investors often add both domestic and international stocks to diversify and improve returns.

Domestic Stocks

Domestic stocks come from companies in an investor’s home country. Traded on local exchanges and priced in local currency. Investing in domestic stocks reduces home bias – overinvesting in local equities despite benefits of global diversification.

Examples are NYSE and NASDAQ for US residents.

International Stocks

International stocks come from companies outside investor’s home country. They provide exposure to different economies, currencies and market cycles – but also pose added risks like currency changes and political instability.

For US investors, examples are London Stock Exchange, Tokyo Stock Exchange and Hong Kong Stock Exchange.

Some companies dual list on both domestic and international exchanges.

Income Stocks

Income stocks are equities paying above-average dividends versus other stocks. Companies offering these stocks focus returns to shareholders via dividends or buybacks rather than reinvesting for growth.

Types of income stocks

- Utility stocks: Stocks from companies that provide essentials like electricity and water. These companies usually have stable cash flows and consistent dividends.

- REITs (Real Estate Investment Trusts) – Stocks from companies that own real estate like apartments and malls. They mostly generate rental income.

Good income stocks feature:

- Low volatility – More stable than growth stocks.

- High dividend yields – Above market average.

- Modest growth – Focus on dividend returns over growth.

Blue Chip Stocks

Blue chips are stocks in huge, well-established industry leaders with strong profits and growth. Their stability makes them among the safest investments.

What are blue chips

Blue chips are stocks in big companies with wide recognition, large market caps and financial soundness. They have long histories of steady performance and dividend payments.

Characteristics of blue-chip stocks

- Huge, well-established companies

- Steady profits and growth

- Pay dividends consistently

- Lower risk

- Provide steady returns

Benefits of blue-chip stocks

- Less risky than other stocks

- Offer stable returns and growth potential

- Help diversify investments

- Give dividend income

Some Famous Blue Chip Names

- Apple

- Microsoft

- Johnson & Johnson

- Procter & Gamble

- Coca-Cola

- JPMorgan Chase

New and Innovative Stock Types

Recently, several innovative stock types have emerged with new opportunities for investors to align investments with their values and capitalize on trends.

- ESG Stocks: Environmental, Social, and Governance (ESG) stocks symbolize companies that prioritize sustainability, social responsibility and ethics. Appealing for investors wanting to make a positive impact.

- Tech Stocks: Technology stocks, especially in innovative fields like AI, blockchain and biotechnology. They attract attention thanks to major growth potential. However, they also bring increased risk and volatility.

As investing evolves, grasping these new stock types can empower investors to capitalize on emerging opportunities.

Different Stock Market Sectors

The stock market has 11 main sectors, each covering a specific industry group. These include:

- Energy

- Materials

- Industrials

- Consumer discretionary

- Consumer staples

- Healthcare

- Financials

- Information technology

- Communication services

- Utilities

- Real estate

Investing across sectors can diversify a portfolio and possibly lower risk. Each sector acts differently to economic conditions and market movements. So a varied portfolio should mix up sectors.

For example, defensive sectors like consumer staples and utilities often do better when the economy fall down. Cyclical sectors like consumer discretionary and industrials might outperform during economic growth periods. By learning each sector’s traits and relation to the overall economy, investors can make smarter stock picks to balance their portfolios.

Different Ways To Classify Stocks

Besides sectors, stocks get categorized based on various qualities like market value, location and investment style.

Market capitalization refers to the total value of a company’s shares. Stocks typically fall under:

- Large-cap: Companies valued at $10 billion or more

- Mid-cap: Companies worth between $2 billion and $10 billion

- Small-cap: Companies worth less than $2 billion

Stocks also get grouped geographically:

- Domestic stocks: Companies headquartered in investor’s home country

- International stocks: Companies based in other countires

- Emerging market stocks: Companies in developing economies

Picking the Right Stocks for Your Needs

Choosing the right stocks for your investment portfolio depends on you; your financial goals, risk tolerance and timeframe.

First, think about personal goals like growing your money long-term or earning income short-term.

Next, assess your risk tolerance which is how much market fluctuation and potential losses you can handle. Young investors with longer timeframes can take more risk. Older investors about to retire may prioritize stability and income.

Diversification is crucial for managing risk and returns. Consider a mix of stocks like growth, value, large-cap, small-cap, domestic and international. Regularly review and adjust your portfolio to realign with goals and risk appetite.

Seeking guidance from a financial advisor helps, especially for new investors or complex situations. They can identify appropriate stocks for your needs and provide ongoing support to stay on track with goals.

In Summary

Knowledge of the various types of stocks is very important for smart investing and portfolio diversification. From common and preferred stocks to growth and value stocks, each one offers distinct traits, risks and rewards.

By learning stock classifications, sectors and innovative offerings, you can better align investments to your goals and risk tolerance. It is of utmost importance that you regularly review and adjust your stocks mix and seek professional advice when required.

Remember — investing always carries some risk. Conduct thorough research, diversify holdings and keep yourself up-to-date on market trends. With solid knowledge of stocks and a disciplined strategy, you have a much higher change of success in stock market.