Share classes let companies categorize their stocks to give shareholders different rights and privileges. Companies issue different classes of shares for several reasons, to keep control, reward early investors or attract certain shareholders.

It is important for investors to know the differences between different classes of stocks i.e. Class A, B and C shares. This helps investors to make more informed trading decisions when buying a company’s stock.

What Are Share Classes for Stocks?

Share classes assign different rights to different shareholders. It includes rights like voting power, dividends, claims to company’s assets and capital. Companies define classes however they want, in their corporate charter.

By using classes, companies can keep voting control when issuing shares in public market. Classes also decide who gets first with respect to profits and assets. Early investors can get more votes per share or better dividends. For investors, learning the differences between share classes matters bigtime in making smart investments.

These stock classes should not be confused with stock types like common and preferred stocks.

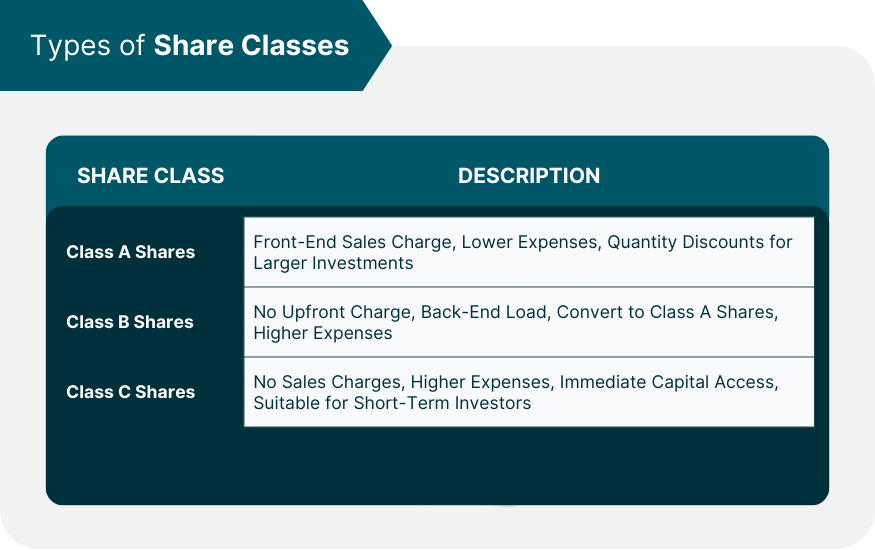

Types of Share Classes

Main share class types are Class A, Class B and Class C. Corporate charters define specific rights and privileges of each class.

Most common differences between share classes relate to voting authority, dividend priority and access to assets if company liquidates. Next sections explain each share class.

Key Differences Between Share Classes

This given summary tells about the differences between classes of shares:

| Category | Class A Shares | Class B Shares | Class C Shares |

|---|---|---|---|

| Voting Rights | Normally 1 vote per share | Voting rights vary | Typically no voting rights |

| Dividends | Regular access | Priority over Class A | Same as Class A (after B) |

| Asset Distribution | Regular priority | Often higher priority | Same as Class A (after B) |

| Availability | Usually public | Limited/not public | Employees/restricted public |

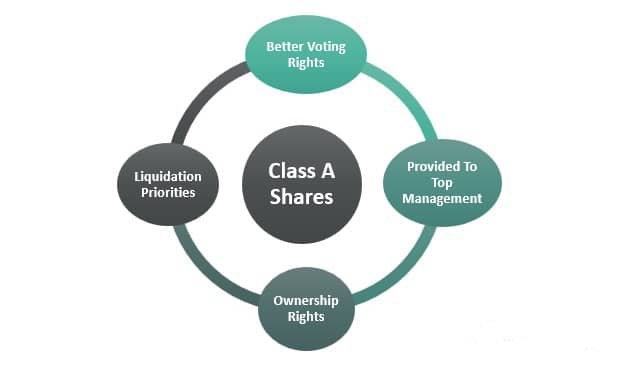

Class A Shares

Class A shares are usually the most common stocks a company issue. They often pack more voting rights and benefits than other classes.

Definition of Class A:

Class A shares typically have more voting power than other classes. Company founders, executives or early investors usually hold them to keep control over decisions.

Class A can also get higher priority for dividends and claims to assets if company liquidates. While details depend on corporate charter, Class A generally gives shareholders the most voting authority and financial rewards.

Characteristics of Class A

Class A shares cost more than other classes. They may not be available to public, as companies reserve them for top brass, founders and early backers. Sometimes Class A can convert to Class B or common stock, but it really depends on company terms. The higher price and limited access reflect Class A’s greater voting power and priority for dividends and assets.

Class B Shares

Class B shares are the most common stock available to public. They usually have less voting rights and privileges than Class A.

Definition of Class B:

- Class B shares are regular shares with less or no special voting rights. Average investors and public often hold them. They don’t need big control over company decisions.

- Class B can get lower priority for dividends and assets than Class A. For different share classes, Class B is considered most basic and accessible for regular investors.

Characteristics Class B Shares

Class B shares are usually more affordable than Class A shares. They’re available to regular investors and can be traded openly. Class B shares typically have lower payback priority if the company goes bankrupt as compared to Class A.

When you look at the different stock classes–A, B and C–Class B shares offer fewer privileges and voting rights than Class A, but regular investors can buy them more easily.

Class C Shares

Class C shares are a less common type of stock that can mean different things depending on the company. They often have different voting rights and restrictions compared to Class A and B shares.

Definition

Class C shares can refer to various share classes depending on the company. They might be used for shares given to employees as compensation or alternate share classes available to public investors. The exact voting rights and restrictions of Class C shares vary by company. When looking at the stock classes–A, B and C–Class C shares are the least standardized and depend the most on how each company defines them.

Characteristics

The details of Class C shares depend on how the company sets them up. They may have different dividend access or voting rights compared to other share types. Companies can use Class C shares to attract certain investors or reward employees.

When considering the stock classes A, B and C, Class C shares are the most flexible and can be customized to meet the company’s needs. But investors should carefully review company’s plan to understand the rights and restrictions before buying them.

Voting Rights and Control

Main difference among Class A, B, C stocks is voting power per share. Class A typically has more votes than other classes, giving Class A holders more say in company decisions. In contrast, Class B may have limited or no voting rights.

This dual-class structure lets founders and executives maintain control while still raising money from public stocks. By keeping Class A shares with exclusive voting power, insiders can make major decisions without as much risk of losing control, even if outside investors own significant portion of companies total shares.

Liquidity and Pricing.

Class- A shares are more liquid and easier to trade openly compared to other classes. More investors like institutions and public hold Class A shares, leading to increased trading volume and market demand.

Meanwhile, Class B shares might be held by insiders like founders, executives or family. This can make Class B less liquid with fewer shares trading openly.

This liquidity and voting gap between share classes can also move their prices. Class A typically costs more than Class B thanks to its greater voting power and liquidity. Bid and ask prices vary between classes based on changing market demand and availability.

Why Companies Issue Different Share Classes

Companies issue various stock classes – A, B & C shares – for several important reasons:

- To maintain voting control with founders and executives, even when shares are issued in the public market. By creating a class of shares with superior voting rights, insiders can make critical decisions with less risk of losing control.

- To provide different financial rewards and priorities to different groups of shareholders. For example, early investors may receive shares with preferential rights to dividends or assets.

- To enable company insiders to make decisions with less risk, since they own shares with more voting power per share. This allows them to retain control even if outside investors own a significant portion of total shares.

Launching multiple share classes when going public lets companies raise money while ensuring founders and execs keep control and affect business decisions. Each share class’s specific rights are defined in the corporate charter.

Market Dynamics and Share Price Differences

The market’s perception and valuation of different stock classes – A, B, C shares – can vary based on the rights of each class. Investors may value share classes with extra voting rights or special dividend access more highly.

The bid and ask spread for Class A, B and C shares can shift based on changing market demand and availability. Class A often trades at a premium over Class B or C thanks to its superior voting and liquidity. However, the price gap between classes may be small if the market doesn’t value the extra rights much.

Factors like financial performance, industry trends and market sentiment can all move the prices of different share classes. Investors should evaluate each class’s specific rights and limits before investing.

How to Choose Between Share Classes

When deciding between classes of stocks – A, B, C shares – investors should think about several key things:

- Voting rights are the main difference between share classes. Class A typically gives more control and impact in company decisions, while Class B and C have limited or no voting rights.

- Class B usually has lower repayment priority if company goes bankrupt and sells assets. So Class B investors might get less money back than Class A.

- Each class’s specific attributes depend on how the company defines them in its charter. Investors need to observe company’s prospectus to understand every class’s rights, limits, and differences.

Ultimately, best share class should match investor’s personal goals and risk appetite. Those wanting more control may like Class A, while those focused on financial returns might pick Class B or C.

Moreover, grasping how sensitive different stocks are to the economy, like cyclical and defensive stocks, can further guide your investment picks when deciding between share classes.

Conclusion

It’s crucial that investors understand differences between different classes of stocks – A, B & C to decide wisely. Class A often gives more votes and control, while Class B and C may have minimal or no voting power.

Researching the company’s class structure and each one’s rights matters before investing. Investors should also think about their goals and risk tolerance when selecting a share class. Carefully weighing these factors helps pick the best class for your needs.