Stock markets play a vital role in economies today, allowing companies to raise money and investors to invest in the growth of those companies. The idea of a stock market has ancient roots tracing back to Rome and medieval Europe.

This article gives an overview of the history and evolution of stock market, highlighting key milestones that shaped their modern form. From the first stock exchange in Amsterdam in 1602 to globalized financial markets and electronic trading, stock markets have changed a lot throughout history.

What Stock Markets Do

A stock market lets investors buy and sell shares of publicly-traded companies. By purchasing a share of a company’s ownership, investors get to benefit from its growth and profits.

Most trading now happens electronically, making markets accessible to more investors. Stock markets help companies raise funds and give investors a place to buy stock shares.

Who Invented Stock Markets?

Stock markets as we know them today developed over time, not invented by one person. The original idea traces back to ancient Rome and medieval Europe where early stock-like tools and joint-stock companies first appeared.

The Dutch East India Company is seen as the first publicly traded company. It issued the first modern stock shares in Amsterdam in 1602 which was a big milestone in stock market history.

However it should be noted that the basic idea of stock market was already present centuries before the Dutch East India Company formally introduced it. So stock market’s invention happened gradually, not due to one individual or event.

Origins of the Stock Market

History and evolution of stock market can be traced back to ancient civilizations and medieval Europe. In ancient Rome, people bought shares in construction companies, shipbuilders and other public firms, like early stock instruments.

During the Middle Ages, the stock idea developed more with joint-stock companies. These companies allowed individuals to invest together in big ventures like trade trips so that risk could be spread among multiple investors.

Merchants and traders in medieval Europe came up with various investment tools too, including selling shares and partnerships. Italian city-states, especially Venice, led the way. Venetian merchants introduced the principle of exchanging debts between lenders which laid the groundwork for modern markets.

While experts debate the exact origins of stock market, early developments in ancient Rome and medieval Europe clearly shaped the stock concept and paved way for formal stock exchanges later.

Where Did the Stock Market Start?

The first formal stock exchange opened in 1602 in Amsterdam, Netherlands. But the idea of a stock market started much earlier in ancient Rome and medieval Europe when early stock-like tools and joint-stock companies first appeared.

You can trace today’s stock markets back to those early civilizations where people bought shares in public firms and invested together in trade trips.

While Amsterdam marks the birth of modern stock markets, the concept spent centuries taking shape across Europe as financial systems evolved and public investing became key for growth.

The First Stock Exchange

The 1602 Amsterdam Stock Exchange stands as the world’s first formal stock exchange. At start, it only traded shares in the Dutch East India Company.

The Amsterdam exchange introduced big innovations like listing fees and regular trading hours that laid groundwork for future markets. These moves helped formalize stock trading and set stage for other global exchanges.

Other Major Stock Exchanges

- Tokyo Stock Exchange (1878): The Tokyo Stock Exchange opened in 1878. It serves as Japan’s largest stock exchange and a key player across Asia. The TSE drove development of Japanese economy and financial markets over the years.

- Hong Kong Stock Exchange (1891): Established in 1891, Hong Kong Stock Exchange or HKEX is Hong Kong’s biggest stock market. It also operates as a global financial hub, letting international investors access Chinese markets. HKEX greatly contributed to the progress of regional economy.

- London Stock Exchange (1773): Running since 1773, the London Stock Exchange or LSE stayed at forefront of global finance for centuries. It ranks among the world’s oldest stock exchanges but still drives Europe and global finance.

- Philadelphia Stock Exchange (1790): The Philadelphia Stock Exchange emerged in 1790 as America’s first stock exchange. With a rich history in the progress of options trading and financial innovation, it played a pioneering role.

- New York Stock Exchange (1792): Founded in 1792, the iconic New York Stock Exchange became the world’s largest stock exchange. For over 200 years, it served as the epicenter of US finance while propelling the global economy.

Evolution of Stock Market Regulations and Oversight

Over time, regulations and oversight have played a key role in shaping stock market development and promoting fair, transparent trading. Some major milestones include:

- The 1720 Bubble Act in England was passed in reaction to the South Sea Bubble. It aimed to stop fraudulent joint-stock companies from launching.

- The 1933 Glass-Steagall Act in the U.S: Enacted during Great Depression, this act split investment banking from commercial banking and founded the Federal Deposit Insurance Corporation (FDIC) to protect depositors.

- The 1933 Securities Act and 1934 Securities Exchange Act established the Securities and Exchange Commission (SEC) and mandated companies to disclose financial data when issuing securities (Stocks, ETFs etc).

- The 2002 Sarbanes-Oxley Act was introduced after huge corporate scandals. This act toughened financial reporting rules and increased penalties for fraud.

- The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act was passed following 2008 Finanical crisis. It brought stricter oversight of financial firms and launched the Financial Stability Oversight Council (FSOC) to monitor systemic risks.

As stock markets continue to evolve, regulators face new tests like fintech, crypto assets and climate risks. Maintaining robust supervision and regulatory resources remains vital to preserve market stability and integrity.

Globalization and the Rise of International Stock Markets

The history of stock markets got shaped a lot by markets in developed countries emerging during 19th and 20th centuries. As these markets grew and matured, they became more interconnected globally, leading to a more globalized financial landscape.

This interconnectedness of global financial markets has enabled greater capital flows across borders, letting companies access funding from international investors. This globalization trend has also seriously impacted growth of emerging markets as these economies have become more integrated with global financial system.

However, the rise of globalized stock markets has also brought new troubles, like increased volatility and potential for financial crises to rapidly spread across borders. So along with the development of international stock markets, efforts to strengthen financial regulations and oversight at both the national and international levels have also happened.

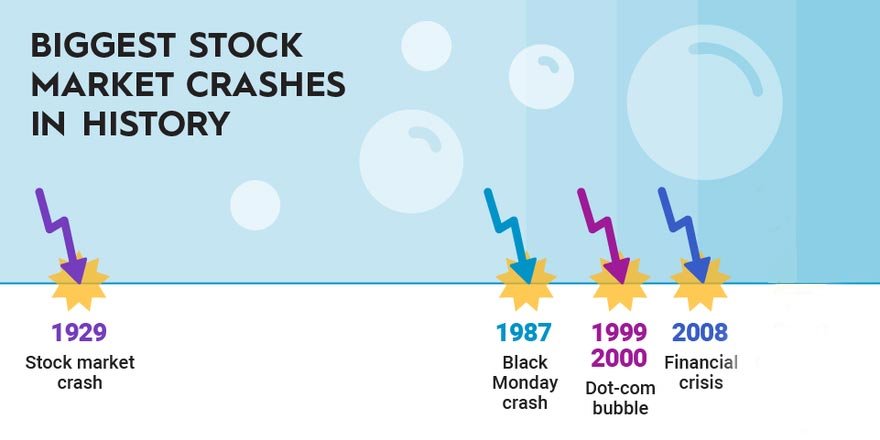

When Major Stock Market Crashes Happened

Throughout the history of stock market, several huge crashes have occurred, each with unique causes and consequences. Some most notable crashes include are:

- Tulip Mania (1637) – One of earliest market bubbles, where tulip bulb prices shot up to crazy levels before crashing hard.

- Wall Street Crash of 1929 – A devastating crash that started Great Depression, with Dow Jones Industrial Average tanking 89% from peak to bottom.

- Black Monday (1987) – The biggest single-day market crash ever, with Dow plunging 22.6% in one day.

- Dot-com Bubble (2000) – The bursting of internet and tech stocks bubble led to 54% drop in S&P 500 over two years.

- Global Financial Crisis (2008) – Triggered by subprime mortgage crisis, it made S&P 500 fall 56.8% and caused severe global recession.

These crashes remind us of inherent risks in stock market investing and why understanding historical patterns and crash triggers matters so much.

Modern Stock Markets

Globalization and electronic trading platforms have transformed modern stock markets. The U.S. stock market and NYSE remain the main players globally.

However, new markets and technology’s impact on trading have increased competition and fragmentation. Alternative trading systems like electronic networks and dark pools have gained major market share, challenging the traditional dominance of stock exchanges.

Importance of the Stock Market

The stock market reflects society’s hopes and fears. It shows what investors and people overall are concerned and optimistic about. It gives companies a place to raise funds and let investors participate in their growth.

Stock markets play a vital role in economies by enabling efficient allocation of money. They allow funds to flow between investors and businesses, supporting expansion, R&D and other initiatives. Well-functioning stock markets are seen as critical for economic growth since they give companies quick access to public capital.

Future Stock Market Trends and Challenges

Key future focus areas include artificial intelligence and machine learning’s potential impact on stock trading. These technologies could revolutionize how investors make decisions and execute trades.

Another challenge is alternative trading platforms and dark pools, which could undermine traditional exchange transparency and fairness. Regulatory obstacles in global finance markets will likely persist too. Policymakers balance encouraging innovation and maintaining stability and investor protection.

Conclusion

The stock market’s history traces an interesting journey over centuries. From early days in ancient Rome and medieval Europe to the complex global system today. Stock markets have crucially facilitated economic growth. They have enabled companies to raise funds and let investors participate in their success.

As we look ahead, stock markets will surely continue evolving. They will be shaped by technological advances, regulations and global dynamics. Despite uncertainties, the resilience shown throughout stock market history gives reason to believe in its everlasting growth potential.