Figuring out the best trading time frame for beginners is a huge deal. It can shape the way you trade, how you handle risk, and how comfy you feel in the trading world.

Picking a time frame that jives with your goals, who you are, and how much time you’ve got can really boost your chances of making smart moves.

By weaving in bits of Technical Analysis, understanding the market, and getting smart about risk, newbies should aim for a time frame that lets them grow their skills without feeling overwhelmed.

Understanding Time Frames in Trading

When we chat about trading, there’s this thing called a time frame that’s pretty important. It’s all about how long you’re watching the market trends, from just minutes to many years. Choosing the right time frame is a big deal because it shapes your whole trading game plan, including how you handle risks.

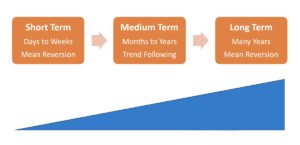

Let’s break down what makes short, medium, and long-term time frames different:

- Short-Term Time Frames:

- These are quick snapshots, lasting from a few minutes to the whole day.

- They’re perfect for traders who’ve got the time to keep an eye on fast-moving prices.

- You’ll see these used a lot in super speedy strategies like Scalping and the hustle of day trading.

- Medium-Term Time Frames:

- Here we’re talking hours to a couple of weeks.

- It hits that sweet spot where you’ve got enough time for thoughtful analysis but still plenty of action.

- This is where Swing Trading Strategies shine, making good use of those 4-hour and Daily Charts.

- Long-Term Time Frames:

- We’re stretching out months to even years now.

- It’s more about catching those big market waves with less need to check in every second.

- For those into Position Trading, weekly and Monthly Charts are your best friends to snag major moves.

For newbies trying to pick their ideal time frame, it boils down to knowing these differences and seeing what fits best with your trading style, how much risk you can stomach, and how much time you can spend on Market Analysis.

Best Time Frame for Beginner Traders

Medium-Term Time Frames

Are you just starting in the trading world? Then, you might want to consider medium-term time frames. They’re like the Goldilocks zone – not too fast, not too slow, but just right for beginners.

Here’s why medium-term might be your best trading time frame:

- Balance: It finds the perfect middle ground. You don’t have to deal with the frenzy of short-term trading or the slow pace of long-term strategies.

- Stress Reduction: Opting for 4-hour and Daily Charts cuts down on stress. There’s more room to breathe and think through your trades.

- Swing Trading: These time frames gel well with Swing Trading Strategies. Perfect if you can’t glue yourself to the screen all day.

Examples:

4-Hour Charts:

- Great if you can spare a few hours each week.

- You get a clean look at price movements without getting overwhelmed by minute-to-minute changes.

- Pair it with Daily Charts for an even clearer market view.

Daily Charts:

- You can track how prices change over an entire day.

- Ideal for swing trades that last from a few days to weeks.

- They’re cleaner and more straightforward than shorter charts, giving fewer false alarms.

Starting with medium-term time frames offers a steady path for beginners. It eases you into making thoughtful choices without jumping at every market twitch. Plus, it’s a smart way to get comfy with Risk Management in Trading and sharpen your skills in Market Analysis.

Long-Term Time Frames

Looking at the big picture can offer a smoother ride in trading, especially for those just starting out. That’s where long-term time frames come in. They zoom out to show us the broader market trends, leaving aside the hectic ups and downs of short-term movements.

Here’s why diving into longer time frames could be a winning move for beginners:

- Overall Market Trends: With long-term charts, you get a clearer view of where the market is headed over substantial periods. This view often proves more reliable than getting caught up in daily or hourly chart chaos.

- Less Time Monitoring: If you can’t watch the markets all day, that’s okay! Longer time frames don’t need constant monitoring, which is perfect for beginners or anyone with a busy schedule.

- Strategic Approach: Embracing a weekly or monthly trading rhythm opens up space for strategic thinking. It matches well with Long-Term Trading and Position Trading, where patience pays off.

Examples:

Weekly Charts:

- Each data point sums up a week of trading action, helping you spot overarching trends without sweating the small stuff.

- They’re great for planning trades that sync up with these bigger movements.

Monthly Charts:

- Zooming out even further, monthly charts lay out the market’s shifts over extensive periods.

- These are super useful for Position Trading, letting you hold onto trades for several months or more based on solid trend analysis.

For newbies, locking eyes on long-term time frames can indeed mark the start of an insightful trading journey. It lines up well with understanding the Forex Market, puts you in good stead with Risk Management in Trading, and fits neatly into a life full of other commitments too.

Short-Term Time Frames

Talking about short-term time frames in trading, it’s all about swift price changes and more trades happening at a faster pace. This kind of trading could be a tough playground for newbies. Quick decisions and keeping an eye on the market non-stop are part of the deal.

Let’s break down what short-term time frames involve:

- Quick Price Changes: Expect the unexpected as short-term charts are all about showing how jumpy the market can be.

- Higher Trading Frequency: With these quick time frames, you might find yourself buying and selling more often in just one day. This is what we call day trading or Scalping.

- Experienced Required: Jumping into Short-Term Trading without much experience or a solid plan for handling risks? Probably not the best idea.

Examples:

- 1-Hour Charts:

- These give you a close-up of how things are moving hour by hour. It’s perfect for planning your moves within the same day.

- You’ll need to stay glued to what’s happening in the Forex Market and be ready to act fast.

- 15-Minute Charts:

- Want to see every tiny shift? The 15-minute chart has got you covered but get ready; it’s a wild ride with lots of noise from all the ups and downs.

- There’s a real chance here that you might end up trading too much, which can crank up both stress and risk levels.

For newcomers, diving straight into short-term time frames might not be ideal because of higher risks and intense nature. Starting with medium or long-term strategies could offer a gentler introduction, allowing for deeper analysis and more strategic thinking when entering or leaving the market.

Factors Influencing Time Frame Selection

Choosing the best trading time frame for beginners isn’t a one-size-fits-all affair. It really boils down to what works best for you, based on a mix of personal traits and practical considerations. Let’s break down the main things you should think about:

- Personality and Trading Style Alignment: Believe it or not, who you are as a person affects how you’ll like to trade. If patience is your virtue, Long-Term Trading might be your jam. On the flip side, if you’re all about seeing results fast, diving into short-term strategies could be more up your alley.

- How Much Time You Can Invest: Let’s talk about time commitment. How much time can you actually put towards trading and doing your homework on the market? Short-Term Trading needs a good chunk of your day, every day. Meanwhile, Long-Term Trading is more of a set-it-and-forget-it strategy that doesn’t need as much constant attention.

- Risk Tolerance and Trading Goals : Every trader has their own comfort level with risk and their own goals. If quick moves and high stakes get your adrenaline pumping (but also bring more risk), short-term might be appealing. But if you prefer a smoother ride with possibly less immediate reward, looking long-term could be better.

Getting these factors straight can really help beginners carve out their spot in trading in a way that feels right for them—leading to trading that’s not just successful but also sustainable.

Pros and Cons of Different Time Frames

Pros

Alright, let’s dive into the world of Trading Time Frames. Whether you like to play it fast and furious or slow and steady, there’s a time frame tailor-made for your trading style. Here’s what’s good about going short-term, medium-term, or long-term:

- Short-term:

- Quick profits? Yes, please! This is all about making money moves in a jiffy.

- It keeps you on the edge of your seat, perfect for those who love living in the market moment.

- Great for folks who can glue their eyes to charts and do quick Market Analysis.

- Medium-term:

- A chill middle path that lets you trade without burning out. You’ll still get to analyze but won’t need to rush.

- Newbies find this less overwhelming since it’s not as high-strung as short-term trading.

- Spot on for catching trends with Swing Trading Strategies without worrying about daily fluctuations.

- Long-term:

- Think big picture here—it’s all about spotting those major moves that matter in the grand scheme.

- Perfect if checking stocks every five minutes isn’t your thing. Less screen time, more life!

- Bonus: Fewer trades mean lesser times you’re coughing up for spreads or commission.

Each time frame sings its own tune, offering benefits that can resonate with different types of traders.

Cons

But hold up—every coin has two sides. Let’s not forget that each timeframe also packs its own set of challenges:

- Short-term:

- Brace yourself; it’s pretty much a high-speed roller coaster that could leave you frazzled.

- Sifting through tons of market noise can get overwhelming and lead to some facepalm moments.

- Beware: More trades might mean thinning out your profits because yep, fees.

- Medium-term:

- Patience is key because striking gold might take a bit longer than in short bursts.

- Might have to watch some juicy short-term opportunities pass by while playing the waiting game.

- Long-term:

- If patience had a test, this would be it. Waiting for rewards can feel like forever.

- Not ideal if you’re looking for action-packed trading days since opportunities come by less often.

Picking your battle comes down to aligning with what fits best with your vibe—be it pace, involvement level, or just how patient you are. Balancing these pros and cons will guide beginners towards choosing a suitable trading jam.

Conclusion

Wrapping up, picking the right trading time frame for newbies means weighing a bunch of things like your trading style, how much risk you can handle, and your daily routine. Here’s what to remember:

- Short-Term Trading is all about quick gains and excitement. Yet, it demands a lot of your time and some solid experience, so it might not be the best starting point for newcomers.

- Medium-term trading strikes a nice balance. It gives you enough time to think through your moves. It’s pretty much the sweet spot for beginners looking to keep their stress levels in check.

- Long-Term Trading plays the long game, focusing on the big picture trends and tuning out the minor fluctuations. It’s perfect if you can’t glue yourself to market updates all day.

In short, the best trading time frame for beginners fits their life goals, how much time they can dedicate to trading and studying up on markets, and how comfortable they are with taking risks.

Whether it’s waiting out for those big wins with Long-Term Trading, finding a middle ground, or diving into the fast-paced world of Short-Term Trading, newcomers should opt for a pace that lets them grow their skills without biting off more risk than they can chew.