The stock market lets investors buy and sell shares of publicly traded companies. But understanding this complex market requires getting familiar with some key stock market terminology. This knowledge helps investors make better investment choices.

This article gives a comprehensive overview of the most important terminology and ideas every investor should know. It covers basic stock market terminology as well as more advanced stuff. By learning these concepts, you’ll be better able to analyze market trends, examine financial reports and make more money with your investment choices.

> List of all stock market terms:

- Stock

- Ask/Offer Price

- Bid Price

- Bid-Ask Spread

- Exchange

- Broker

- Bull Market

- Bear Market

- Trading Account

- Volatility

- Yield

- Exchange-Traded Funds (ETFs)

- Mutual Funds

- Market Capitalization

- Earnings Per Share (EPS)

- Price-to-Earnings Ratio (P/E Ratio)

- Dividend and Dividend Yield

- Market Order vs Limit Order

- Short Selling

- Margin Trading

- Options Trading

- Market Indexes

Basic Stock Market Terminology

It’s very important for stock investors to know fundamental terms. Here are some key terms every investor should know:

Stock: A stock represents ownership in a company. Buying a stock makes you a shareholder who owns a small piece of the business.

Ask/Offer Price: This is the lowest price a seller will accept to sell their shares of a certain stock.

Bid Price: The highest price a buyer agrees to pay per share for a specific stock.

Bid-Ask Spread: The difference between the maximum bid and minimum ask prices for a stock. It shows supply and demand.

Exchange: A marketplace where stocks and other securities get bought and sold, like the New York Stock Exchange (NYSE) and NASDAQ.

Broker: A licensed professional who buys and sells stocks for investors in return for a fee or commission.

Bull Market: When stock prices rise 20% or more due to optimism and confidence among investors.

Bear Market: The opposite of a bull market. Stock prices fall 20% or more while pessimism grows.

Trading Account: An account with a licensed broker that lets you buy and sell stocks and other securities.

Volatility: Amount of uncertainty or risk seen in a stock’s price fluctuations. High volatility means rapid, major price variations.

Yield: Income return on an investment, often shown as a percentage. For stocks, usually refers to dividend yield – the annual dividend divided by the share price.

Knowing these key terms helps you understand financial news, analyst reports and make educated investment decisions. As you learn about the market, remember that knowing the basics well is important for success.

Advanced Stock Market Terminology

As investors go further into trading, it’s crucial to know complex ideas and terms. Here are some advanced concepts to help you better understand the terrain:

Exchange-Traded Funds (ETFs): Funds that trade on stock exchanges like individual stocks. They typically track an index, sector, commodity or other asset, providing a diverse portfolio in a single security.

Mutual Funds: Professionally managed investment portfolios that pool money from various investors to buy securities like stocks, bonds and short-term debt. They provide a convenient way to diversify.

Market Capitalization: Total value of a company’s outstanding shares. Calculated by multiplying number of shares by the current market price per share.

Earnings Per Share (EPS): An important financial metric showing a company’s profitability. Calculated by dividing net income by number of outstanding shares.

Price-to-Earnings Ratio (P/E Ratio): A valuation metric comparing a stock’s price to earnings per share. It helps investors see if a stock is overvalued or undervalued relative to earnings.

Dividend and Dividend Yield: Dividend is a portion of earnings paid to shareholders, usually in cash. Dividend yield is the annual dividend divided by stock price, shown as a percentage.

Market Order vs Limit Order: Market order buys/sells stock at best available price. Limit order specifies maximum purchase price or minimum sale price for more control.

Short Selling: Borrowing shares to immediately sell them, expecting the price will drop so they can be repurchased cheaper later for a profit.

Margin Trading: Borrowing money from a broker to buy securities, using the invested securities as collateral. This amplifies potential gains and losses.

Options Trading

Options give the holder right to buy (calls) or sell (puts) an asset at agreed price and date, but don’t force them to follow through.

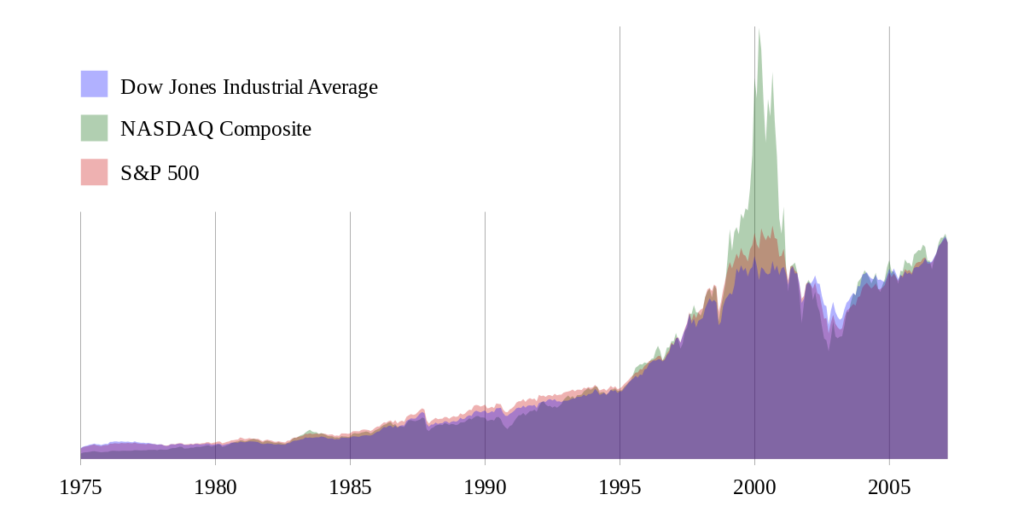

Market Indexes

Indexes track performance of stock groups to snapshot the overall market or an industry. Some key indexes are:

- Dow Jones Industrial Average (DJIA): Covers 30 big U.S. public companies

- S&P 500: Follows 500 large American stocks

- Nasdaq Composite: Over 2,500 stocks on Nasdaq exchange, mostly technology companies

What Makes the Stock Market Unique

The stock market has distinctive features that investors must know, which are:

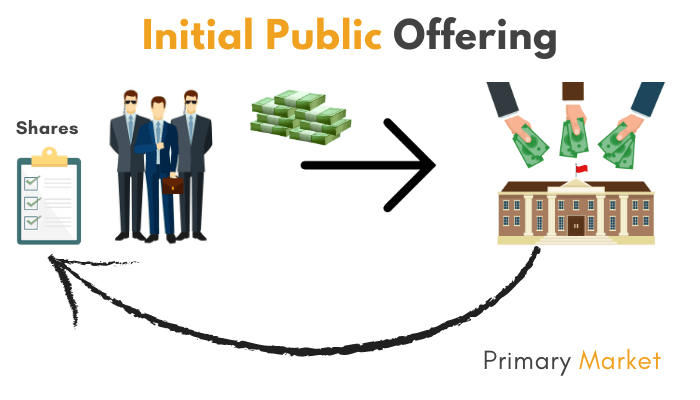

Initial Public Offerings (IPOs)

IPOs allow private companies to offer shares to public for the first time. This lets investors buy into a growing company.

Blue-Chip Stocks

Shares of huge, well-established financially stable companies with long histories of steady growth and dividends. They are considered lower risk stocks than unknown smaller companies stocks.

Penny Stocks

Low-priced shares from tiny companies trading under $5 per share. Often seen as risky plays due to little liquidity, financial data or regulation around them.

Over-the-Counter (OTC) Stocks

OTC stocks don’t list on major exchanges like NYSE or Nasdaq. They trade directly between buyers and sellers instead. Can be harder to research and less liquid than exchange-listed stocks.

Stock Splits

Split stocks increase number of outstanding shares by dividing existing ones into multiple new shares. Reduces price proportionately. Makes shares more affordable and accessible to more investors.

Stock Buybacks

Buybacks (or share repurchases) happen when a company purchases its own outstanding shares from the market. It reduces shares available and can boost value of remaining ones.

Market Sentiment and Investor Psychology

Market sentiment refers to overall investor attitude toward a particular stock or market. Investor emotions like fear and greed can lead to irrational choices that drive prices up or down.

Truely understanding market sentiment and investor psychology is very important for determination of stock prices because emotions like fear and greed can greatly affect stock prices.

Comparative Terminology Analysis

When investing in stocks, people use different approaches and strategies to make decisions. It’s important to understand similarities and differences between these strategies to pick which one best matches your goals and risk comfort. Here we’ll compare key terminology for different investment analysis methods.

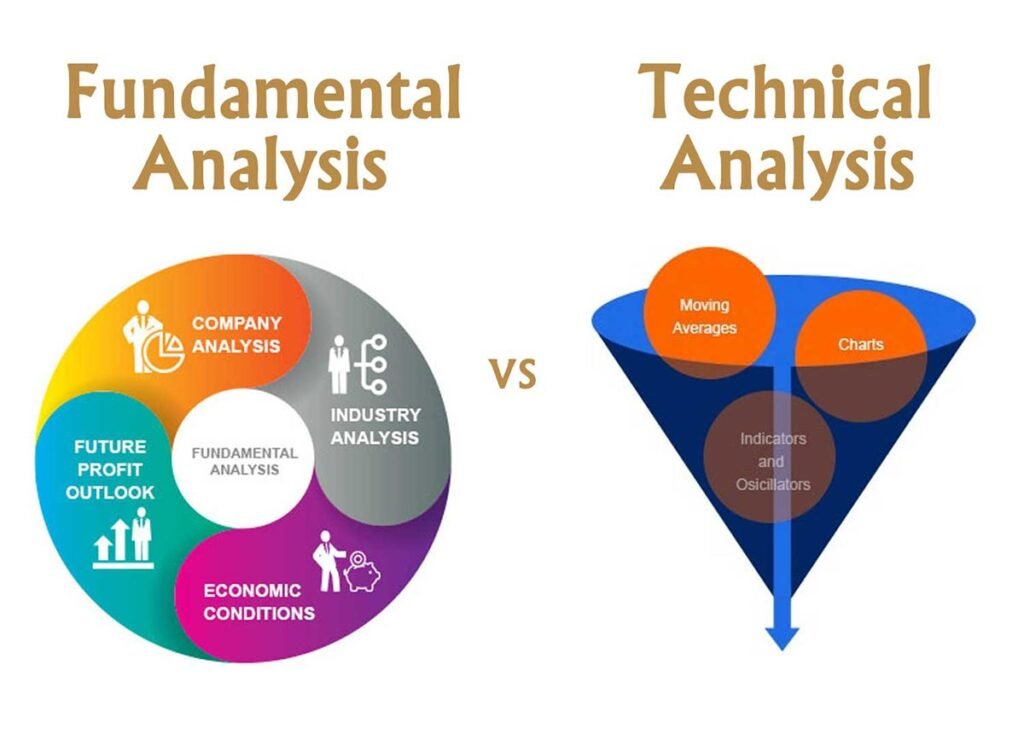

Fundamental and Technical Analysis

- Fundamental Analysis: Looking at financial statements, industry position and economic factors to calculate a company’s true value and growth potential. Fundamental investors focus on metrics like earnings per share, price-to-earnings ratio and market cap.

- Technical Analysis: Analyzing historical price and volume data to spot patterns and trends to predict future price movements. Technical analysts use charts and indicators to find potential buy and sell signals.

Day Trading and Long-term Investing

- Day Trading: It involves buying and selling securities within the same trading day. The goal is to benefit from short-term price changes. Day traders typically use technical analysis and require significant time and skill for monitoring the market and executing trades.

- Long-term Investing: Long-term Investing means holding securities for years or decades to gain from long-term growth and compounding returns. Long-term investors generally focus on fundamental analysis and care more about a company’s actual business performance and future prospects.

Active Investing vs Passive Investing

- Active investing means actively managing a portfolio by regularly trading securities to try exceeding a benchmark or market index. Active investors often use fundamental or technical analysis, which can mean higher trading expenses.

- Passive investing involves investing in a diverse portfolio matching a specific market index like the S&P 500. Passive investors aim to equal the index performance rather than beat it, typically meaning lower fees and less frequent trading.

Keep Learning as a New Stock Market Investor

Mastering investing terms is an ongoing learning process for stock market beginners. Financial literacy and ongoing education are critical for making informed decisions and staying ahead in today’s dynamic stock market landscape.

Why Financial Know-How Matters: Getting a solid grip on money concepts, how markets work and investment strategies is essential if you want long-lasting success. Make learning and keeping up with market news and developments, a priority.

Good Resources to Learn Investing Lingo:

- Online Classes: Lots of online platforms have comprehensive courses on stock market basics, trading tactics and investment analysis.

- Books: Reputable books by industry pros can give you in-depth knowledge and real-world insights into investing terminology and principles.

- Financial News Websites: Reliable financial news websites and blogs help investors stay up-to-date on market trends, company news and industry happenings.

Practice with Virtual Trading Platforms: Many brokers and educational platforms offer virtual trading accounts, letting beginners safely try out strategies and apply their knowledge.

Getting Help from Experienced Investors or Financial Advisors: Surrounding yourself with people who know the basics as well as learning from their experiences can really help you understand the complex stock market better and become a better investor faster.

Conclusion

In this extensive guide explaining key stock market terminology, we covered a lot of essential concepts and terminologies related to the stock market. Knowing these terms is of the utmost importance for investors to make smart choices and handle the complicated financial markets smoothly. Become a successful investor by keeping up with the ever-changing dynamics of the stock market and by continuing to expand your knowledge.