Introduction

Rivian Automotive, Inc. (RIVN) has been making waves in the Electric vehicle (EV) market since it started up in 2009. Its goal is clear: to make trucks and SUVs electric, targeting a vehicle category widely known for its environmental impact.

Investors have kept a close watch on RIVIAN’s stock journey, which recently saw a sharp 30% drop at the start of 2024. This now places it 79% below its initial public offering price of $78.

We’re going to find out “is RIVIAN stock a good buy” by considering its present stock performance, financial stability, market trends, and projections for what lies ahead.

Weighing the Risks and Rewards: Is RIVIAN Stock a Good Buy?

Volatility has been a trademark of RIVIAN’s time on the stock market, with swings reflecting just how competitive the EV industry competition really is. Current analyst price targets for RIVN hold out hope for growth despite the current slump.

The big players who hold stakes in RIVIAN—including names like Amazon.com, Inc. (AMZN), T. Rowe Price Associates, Vanguard Group Inc., and BlackRock Inc.—reveal serious interest and belief in where the company could be heading in the long term.

To properly answer the question “is RIVIAN stock a good buy” let’s get into the nitty-gritty of these elements and key players.

RIVIAN’s Current Stock Performance

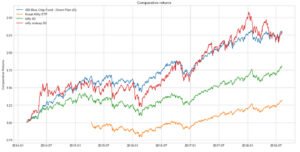

RIVIAN Automotive, Inc. (RIVN) has faced quite the rollercoaster in terms of its stock performance, an important factor to ponder when questioning whether buying RIVIAN stock is a good move. As we entered 2024, there was a noticeable 30% dive in RIVIAN’s share price—starkly different from the spike at last year’s end. Now sitting 79% under its initial public offering (IPO) price of $78, these numbers are raising some serious flags about how shaky this stock may be amidst fierce Electric vehicle (EV) market competition.

Comparison with IPO Price

Putting RIVIAN’s current share price up against the one they launched with tells us there’s been quite a slump. Although it kicked off strong at $78 and soared to $106.75 on opening day, eventually climbing as high as $179.47, times have changed. The latest numbers show a hefty decline from those early days of promise—making investors think twice about the stability and future of their bet on RIVIAN.

Recent Stock Trends

Lately, RIVIAN’s shares have really been through a whirlwind—a definite reflection of the cutthroat nature of that EV industry competition. On a brighter note though, analyst price targets for RIVN hold out some hope that things might look up from where they stand now. These peaks and valleys in valuation are critical for potential shareholders to weigh up: they speak to both the inherent perils and possible comeback story tucked away in RIVIAN’s market journey.

RIVIAN’s Financial Health

Turning our gaze towards RIVIAN Automotive, Inc. (RIVN)’s finances is crucial while mulling over “Is RIVIAN stock a good buy.” Making strides within the bustling Electric vehicle (EV) market, RIVIAN’s monetary standing could make or break an investment decision.

Financial Statements

RIVIAN’s financial health can be scrutinized by looking at its balance sheet. There, we find shareholders own equity worth $10.6 billion. The company has a debt load of $2.7 billion, which leaves us with a debt-to-equity ratio sitting at 25.8%. Their assets come in at $16.5 billion versus liabilities tallying up to $5.9 billion. But the past year wasn’t all smooth sailing; by September 30, 2023, RIVIAN reported net losses of $5.634 billion—a sizable dip of 24.78% compared to last year.

Turning an eye to earnings per share (EPS), there’s a similar downward trend marking a decrease of 6.96%, with the latest figure showing minus $6.02 for the same period.

Revenue and Market Capitalization

Even with these losses, not all indicators are gloomy for RIVIAN—the company’s revenue actually saw a sharp uptick, surging to $3.782 billion over twelve months leading up to September 2023, which is an impressive leap of 260.53% from the previous year.

As January 2024 rolls around, this acceleration places RIVIAN’s market cap firmly at $14.21 billion—nudging it into the position of being the world’s 1187th most valuable business.

To sum it up: yes, certain numbers do raise eyebrows in concern for RIVIAN, but their robust surge in sales and stake in the EV sector could very well make them an attractive option for investors thinking long-term.

Market Analysis

Looking out onto the landscape of the Electric vehicle (EV) market, we see it pulsing with life and competition that’s nothing if not fierce—everyone’s trying to carve out their patch under the sun.

In this teeming ecosystem stands RIVIAN Automotive, Inc. (RIVN) who threw down its gauntlet as a newbie among titans such as Tesla, Inc. (TSLA) and veterans like Ford Motor Company (F); we also have newer contenders throwing into the mix like NIO Inc. (NIO) and exploring further lands is BYD Auto (BYDDF)>

The stakes? Market share—and whether RIVIAN stock a good buy or not may just rest on how well they can stand out from this pack and claim some for themselves.

Competitive Landscape

RIVIAN has carved out a special spot for itself in the EV market by focusing on electric trucks and SUVs that can handle off-roading. It’s up against big contenders like Tesla’s Cybertruck and Ford’s electric F-150. How RIVIAN measures up to these rivals gets reflected in its market value and analyst opinions. A key thing to watch is how well RIVIAN can keep innovating and pushing its production capacity because this will be a major factor in figuring out if “is RIVIAN stock a good buy” for investors.

Market Dynamics

The world of electric vehicles is fast-paced. Tech breakthroughs, changing buyer preferences, and new rules from governments are all part of the game for businesses like RIVIAN. The ups and downs of RIVIAN stock volatility, along with what big investment firms think of the company, give us some insight into how the market views RIVIAN’s future potential. To make savvy investment choices about “is RIVIAN stock a good buy,” it’s critical to grasp these shifting forces.

Future Projections

What lies ahead for RIVIAN Automotive, Inc. (RIVN) keeps investors and market watchers on their toes. Analysts have placed their bets, imagining the stock could hit $24 within a year—a jump from where it stands now. RIVIAN’s sales have seen impressive spike-up, painting an optimistic picture of what’s next for them money-wise. But when asking if investing in RIVIAN a smart move, it much depends on whether they can keep up their performance and start turning profits.

Revenue and Profitability Projections

Expectations are that RIVIAN will continue to see sales climb, with predictions suggesting quite a leap soon. The company dreams big—it’s aiming for 10% of the EV market by 2030. However, despite growing revenue numbers, profits—or rather, the lack of them—are still raising eyebrows since losses have been heavy up until now. For those sizing up “is RIVIAN stock a good buy,” weighing these hopeful forecasts against the bumps that come with being in the EV race is necessary.

Stock Price Predictions

Predicting where the price of RIVIAN’s stock will head is challenging. Several analyst forecasts do paint an optimistic picture with a chance for considerable growth. Keep in mind, the future of RIVIAN’s stock hinges on how well it can up its production game and keep an eye on costs amidst intense competition in the EV sector. Prospective investors need to weigh these aspects – productivity, cost management, and market rivalry – against RIVIAN’s history of fluctuating stock prices and what analysts are saying before deciding if RIVIAN is a good buy.

Conclusion: Is RIVIAN Stock a Good Buy?

When looking at RIVIAN’s money matters, there are mixed feelings. It raised some eyebrows by taking on $1.5 billion in debt through bonds recently. Yet, its shareholder equity tallies up to $10.6 billion against debts of $2.7 billion, showing a relatively stable debt-to-equity ratio.

Analyst price targets for RIVN lean toward optimism as well—with predictions setting an average goal of $25.42 within the next year. That implies a striking jump from where it stands today, especially as RIVIAN has been outperforming earnings per share (EPS) expectations time after time.

We also shouldn’t overlook institutional ownership of RIVIAN, with heavyweight backers like T. Rowe Price Associates, Vanguard Group Inc., and BlackRock Inc., holding steady with their investments.

Still, let’s not forget the swift fall in value that hit RIVIAN recently; plus it’s playing tough against giants like Tesla, Inc. (TSLA), NIO Inc. (NIO), and BYD Auto (BYDDF) in bustling EV battlegrounds.

Wrapping things up—yes, there are risks due to the unpredictable nature of RIVIAN’s shares along with cutthroat industry competition. Nevertheless, solid business foundations suggest room for growth particularly when we consider an expanding EV scene driven by favorable analyst sentiments.