Swing trading is all about catching the wave of Volatility and Liquidity to snag profits from stock price movements over a few days or weeks. If you’ve ever wondered how to use stock screener for swing trading, you’re in for a treat. We’re going to show you how to comb through countless stocks quickly and zero in on the most thrilling Trading Opportunities.

In this guide, we’ll dive into the heart of swing trading. You’ll learn how to boost your Trading Strategies, keep risks low, and bump up your chances of winning big in the market game. So, hang tight as we unpack all the must-know tools and tactics that will supercharge your swing trading journey.

Overview and Importance

Understanding Swing Trading

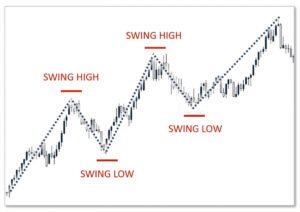

Picture swing trading as your way of surfing through short- to medium-term waves in stock prices. It could last anywhere from several days to a couple of weeks. This strategy isn’t just about going with the flow; it’s grounded in Technical Analysis for spotting those prime Trading Opportunities, though peeping into some Fundamental Analysis now and then doesn’t hurt either.

Swing traders are like treasure hunters, aiming to bag profits from the mini trends fluttering between peaks and troughs. What makes it even cooler? It’s usually less dicey than other quick-trade methods because it banks on rock-solid Technical Analysis and doesn’t cling too long to positions—slashing down the scare factor of hanging onto an unliquidated position.

The Importance of Stock Selection

Selecting the right stocks for swing trading hinges on a deep dive into technical indicators like Moving Averages, Volume, Support and Resistance Levels, and Price Channels. These tools are like secret codes that help spot new momentum ASAP, cracking open the door to awesome Trading Opportunities.

Getting savvy with how to use stock screener for swing trading could be a game-changer in picking stocks. It’s like having a superpower that sorts through thousands of stocks in a blink, spotlighting those gems that match your hunt for big-time Price Movements. This step is crucial in swing trading because it zeroes in on stocks with the top potential for hefty gains.

Stock Screeners: An Essential Tool for Swing Traders

What is a Stock Screener?

Imagine having a magic filter that sifts through mountains of stocks, leaving you with only those that fit your golden criteria. That’s what a stock screener does. For folks looking to ride the waves of short- to medium-term Price Movements, mastering how to use stock screener for swing trading is key. It’s all about finding those stocks bubbling with the perfect mix of Volatility and Liquidity—the ingredients for successful trades.

Benefits of Using Stock Screeners

Stock screeners are like having your own market detective agency. They trim down hours of grunt work into minutes, guiding you straight to the hot leads—those juicy Trading Opportunities.

By punching in specifics, such as must-have figures from Technical Analysis, choosing by size like through Market Capitalization, or eyeing those with strong Earnings Growth, you instantly corner the market on stocks ready to make significant jumps. This laser-focused hunt is vital because timing is everything in swing trading—jump too late or too early, and you might miss out on profit or court unnecessary risk.

Customizability and User-Friendliness

The cream-of-the-crop stock screeners understand every trader dances to their beat. They let you customize settings, ensuring indicators like Moving Averages, Support and Resistance Levels, and Price Channels, along with fundamentals such as Earnings Growth align perfectly with your playbook.

Ease of use is also part of the deal. A smooth interface means less time fumbling and more time executing killer strategies efficiently.

Setting Up Your Stock Screener

Defining Your Criteria

Kicking off your swing trading adventure means getting your stock screener settings just right. Pin down what matters for your trades. Think about technical stuff like Volume and Market Capitalization, plus any other factor that matches up with what you’re aiming to achieve. Here’s an example of how you might set up your criteria:

| Criteria Category | Description |

| Technical Indicators | Use indicators like Moving Averages, Support and Resistance Levels, and Price Channels to identify potential Trading Opportunities. |

| Volume | Look for stocks with high trading Volumes, as these are more likely to have the Liquidity needed for swing trading. |

| Market Capitalization | Consider the size of the company, as larger companies tend to have more Liquidity and are often less volatile. |

| Earnings Growth | Stocks with strong Earnings Growth can be good candidates for swing trading, as they often exhibit Price Movements that can be capitalized on. |

Picking Your Technical Indicators

Let’s talk about tools of the trade:

- Moving Averages are your friends for spotting trends and figuring out when things might flip.

- For those moments you’re hunting for breakout stars, Price Channels have got your back.

- Finding the perfect spots to jump in or bow out? That’s where Support and Resistance Levels shine.

- And don’t forget about Volume! It’s like a buzz meter—high buzz means lots of investor eyes and possibly big moves ahead.

Fundamental Factors

Sure, charts and patterns are great, but let’s not ignore the basics. Stuff like:

- How fast is this company growing its earnings?

- What does revenue growth look like?

- Are profit margins looking healthy?

- Is the company making smart use of its equity?

- What’s the debt situation?

By mixing both arts—the technical indicators with these fundamental checks—you’ll set yourself up on solid ground to spot those golden Trading Opportunities.

Using Stock Screeners Effectively

Identifying High-Volume Stocks

In swing trading land, Volume speaks volumes. A stock buzzing with activity is more fluid, making it easier for you to make your move without causing ripples. Use your stock screener to tune out the quiet ones and keep tabs on stocks that are all the rage. Watching for sudden spikes in activity could lead you right before a price jump.

Analyzing Price Movements

Tracking those lucrative Price Movements is non-negotiable. Set up your screener to catch stocks either climbing up or bouncing back with style. This way, sifting through potential wins becomes a breeze, putting you right where you need to be—for nailing those high-potential Trading Opportunities.

Customizing and Saving Screens

The beauty of many stock screeners is that they let you tweak and save your screens for later. This nifty feature is a game-changer because it means you don’t have to start from scratch every time.

By tailoring and saving your screens, you pave the way for a smoother ride down the road. It turns the chore of finding potential trades into a breeze, making your swing trading journey with a stock screener much more efficient.

Popular Stock Screeners for Swing Trading

Overview of Top Screeners

Lucky for swing traders, there’s no shortage of amazing stock screeners out there. Each comes with its own set of perks. Here are some crowd-pleasers:

- Trade Ideas: This one shines with its real-time AI-powered scans and automatic trading features, stealing the hearts of many active traders.

- Finviz: Boasting advanced visuals and the ability to test how strategies would have fared in the past, it’s a heavyweight champion for swing traders.

- StockFetcher: What’s cool here is you can craft custom screens using everyday language. If your strategy leans heavily on technical and Fundamental Analysis, you’ll appreciate this one.

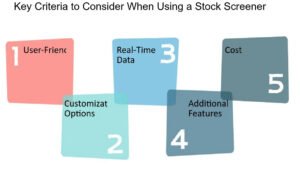

Evaluating Stock Screeners

Picking out the perfect stock screener for swing trading? Mull over these must-haves:

- Technical Analysis Tools: Make sure it’s loaded with all the essential Technical Analysis gadgets—think Moving Averages and Support and Resistance Levels.

- Fundamental Analysis Data: Chase after screeners that dish out deep dives into financial health indicators critical for spotting long-term wins.

- Real-Time Data: For those quick on their feet movements characteristic of swing trading, live data is non-negotiable.

- Customization: Being able to customize and revisit your favorite search criteria without breaking a sweat? Priceless.

- User Interface: A smooth, user-friendly interface means less hair-pulling and more action.

- Pricing: Balance cost against what you’re getting; ensure it dovetails nicely with both budget constraints and feature expectations.

By understanding how to use stock screener for swing trading each screener will steer you towards finding your match made in heaven for swing trading strategies.

Swing Trading Strategies and Stock Screeners

Integrating Screeners into Your Strategy

- Align your screening process with your trading plan’s core principles.

- Choose filters based on your go-to Technical Analysis tools:

- Moving Averages

- Support and Resistance Levels

- Not forgetting to mix in some Fundamental Analysis metrics like:

- Earnings Growth

- Spot stocks ready for significant Price Movements using screeners.

- Consider the stock screener a crucial part of your trading strategy toolkit.

- Look for stocks that perfectly match your criteria for jumping in or bowing out.

Risk Management

- Pick out stocks fitting within what you’re willing to gamble and hope to gain, all through stock screeners.

- Keep your portfolio diverse by wisely choosing different stocks.

- Use those same screeners to set up Stop-Loss Orders, grounding them in technical know-how.

- Get ahead of potential losses by being smart with your Risk Management.

- Brace yourself for the unpredictable swings of market Volatility and the smooth sailing or rough seas of market Liquidity.

- Aim to safeguard your capital while also chasing after those lucrative deals.

By mastering how to use stock screener for swing trading, you unlock a superior skill set for spotting trades that not only fit snugly within both your bold plans and careful caution but might also turn the tide in favor of bigger wins.

Conclusion

Getting the hang of using a stock screener for swing trading is key for traders eager to grab hold of market opportunities. These nifty tools are fantastic at:

- Zooming right into stocks boasting just the right kind of action and flow, thanks to their ability to filter by desired levels of Volatility and Liquidity.

- Letting you fine-tune your hunt with pinpoint accuracy through reflections on price changes, volumes involved, allowing precise decisions based on solid readings from known as powerful allies in seeking out those prime spots ripe with opportunity.

Ultimately, stock screeners aren’t just handy—they’re essential gadgets that refine trading strategies. They have an uncanny ability to heighten one’s game in swinging trades toward success.