Stocks represent ownership in a company and are key to financial markets. Knowing about different stock types helps investors make smart choices and companies raise money they need.

Two main stock categories are common stock and preferred stock. Each has unique features and investor benefits worth noting. This article explains common and preferred stocks, highlighting key differences and why grasping these two stock types matters.

Common vs Preferred Stocks

- Common stock represents ownership and grants shareholders voting rights. Owners can vote on big company decisions, like picking board members. The stock value can grow over time if business booms, but dividend payments vary depending on profits and board choices.

- Preferred stock, however, has priority over common for dividends and claim on assets if the company is liquidated. Preferred shareholders usually lack voting rights but receive fixed dividends, paid before common shareholders.

- When comparing the two types, common stocks differ from preferred stocks in ownership rights, voting privileges and dividend payments.

Key Differences: Common vs Preferred Stocks

The main differences between common and preferred stocks are summarized here:

| Factor | Common Stock | Preferred Stock |

|---|---|---|

| Dividends | Variable, paid after preferred dividends | Fixed, paid before common dividends |

| Voting Rights | Yes | Usually No |

| Appreciation Potential | High | Limited |

| Priority in Liquidation | Last | Higher than common, after bondholders |

| Risk | Higher | Lower |

| Callability | No | Sometimes |

| Convertibility | No | Sometimes |

Dividend Differences

- Common stocks pay variable dividends, declared by the board without guarantees. The company must pay preferred shareholders first before common shareholders see dividends. Typically, preferred stock dividends have higher yields than common stock.

- Preferred stocks pay fixed dividends set when issued. These come before any common dividends. Preferred dividends usually equal a fixed percentage of stock par value, making them more reliable and consistent than common variety.

Voting Rights

Common and preferred stocks differ big on voting rights. Common shareholders usually can vote on major company issues like board member elections, mergers, policies, etc. Their vote strength is typically tied to how many shares they own.

Preferred shareholders however, usually lack voting rights. They instead get priority on dividends and asset claims if surrendered. Though some preferred shareholders, especially in private firms, may enjoy special voting rights or protections.

Apperication Potential and Risk

Evaluating common versus preferred stocks should weigh their return potential and risks too.

- Common stocks offer higher possible returns through price appreciation if the company succeeds and share price rises. But greater rewards mean greater risk – common share prices swing more wildly with market shifts.

- Preferred stocks meanwhile have limited growth prospects, as their value links more to fixed dividends not corporate growth. This greater stability means preferred stocks get viewed as less risky. But their capital gain potential stays restricted.

Investors should assess their risk appetite and goals when picking between common and preferred shares.

Liquidation Priority

If a company liquidates, common shareholders get leftovers. While preferred shareholders have higher priority claims on assets.

If a bankrupt or dissolving company first pays off creditors and bondholders, preferred shareholders can next receive par value per share before common shareholders get remnants.

So if liquidated, common shareholders may get little to nothing while preferred shareholders have better odds of recovering a percentage of their investment.

Callability and Convertibility

Preferred stocks may also carry special features that are not part of common stocks – namely callability and convertibility.

- Callable preferred stocks let the issuer redeem or “call back” the shares at a set price and date. This gives companies more control over their business, valuable if market prices rise above call price. But callable shares also risk investors losing future dividends if redeemed prematurely.

- Convertible preferred stocks allow investors to swap their preferred shares for a fixed number of common shares later on. This grants extra protection and potential to enjoy the company’s growth.

Valuation

Common stocks get valued based on corporate prospects and investor sentiment. Investors weigh factors like earnings, revenue trajectory, competitive position and future prospects. So common share prices tend to stay volatile across market shifts.

Preferred stocks however resemble fixed-income securities, valued through their dividend payments and comparable yields of other fixed-income products.

Some key valuation factors are as follows:

- Dividend yield and coverage

- Liquidation preference protection

- Comparable preferred stocks and bond yields

With their fixed-income nature and lower risk, preferred prices usually swing less than common prices.

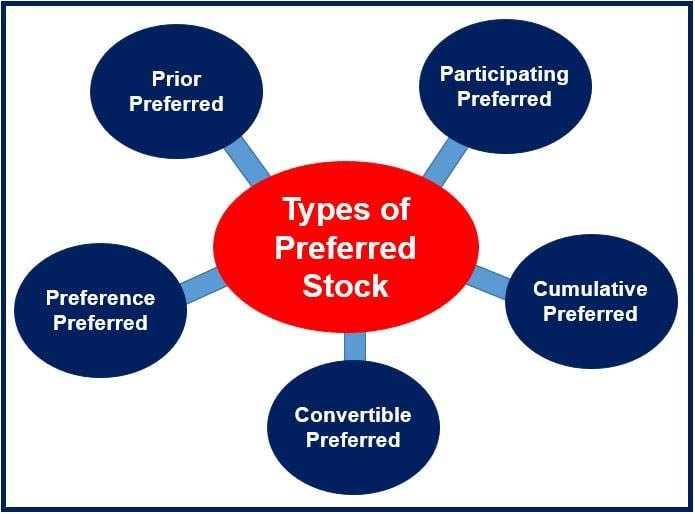

Types of Preferred Shares

Preferred stocks come in different forms, each with unique traits suiting different investor needs, including:

- Cumulative preferred: Unpaid dividends accumulate and the company must pay them before common shareholders get dividends.

- Non-cumulative preferred: Missed dividends don’t accumulate and disappear permanently if skipped.

- Participating preferred: Investors may get extra dividends if the company hits financial targets, on top of the fixed dividend rate.

- Convertible preferred: Shares can change into a set number of common shares, letting investors tap the company’s equity growth.

- Callable preferred: The issuer can redeem these shares at a pre-set price, providing financial flexibility.

Every preferred stock type balances risk, returns and control differently. Investors can choose the one fitting their strategy best.

Common Stock Pros and Cons

Both common stock and preferred stock have some advantages and disadvantages for investors to consider:

Pros

- Common stocks are more trading frequency than preferred, making them more liquid and easier to buy and sell.

- Higher potential returns if share price rises on strong company performance.

- Voting rights to influence major corporate decisions.

Cons

- No guaranteed dividends, depending on profits and board decisions.

- Lower priority for payouts than preferred & creditors in bankruptcies/liquidation.

- More volatile share prices than preferred stocks.

Pros and Cons of Preferred Stock

When comparing common vs preferred shares, it’s key to weigh pros and cons of preferred stock:

Pros

- Preferred stocks tend to deliver higher dividend yields than common stocks.

- Preferred shareholders get priority for dividend payments over common shareholders.

- Preferred stocks see less volatile prices compared to common stocks.

- If company liquidates, preferred shareholders have higher claim on assets than common shareholders.

Cons

- Preferred shareholders usually lack voting rights that common shareholders have.

- Preferred stocks offer limited potential for price appreciation compared to common stocks.

- Some preferred stocks might get called back by the issuing company, potentially limiting returns.

- Preferred stocks tend to be less liquid than common stocks, making them harder to buy or sell at desired prices.

How Do I Use Common Stock to Vote at Company Meetings?

As a common shareholder, you can vote on major company decisions, influencing future direction. This is a key plus for common vs preferred shares.

To vote your shares, you can go to the annual general meeting (AGM) or vote by proxy if you can’t attend in person. At AGM, you vote on issues like electing directors, approving mergers and shaping policies.

Your voting power depends on number of shares owned and the voting structure. With statutory voting, you get one vote per share for each board seat. With cumulative voting, you can allocate all votes to one or more board seats, favoring small investors.

To stay informed on voting matters, review proxy materials from the company, covering what’s up for vote and how to cast your ballot.

Deciding Between Preferred or Common Stock for Investing

Choosing to invest in preferred or common stock depends on your goals and appetite for risk.

Common stock has more potential for higher returns if the company does well. But it also has more risk because dividends and getting your money back take a backseat.

Preferred stock gets you more steady dividend cash flow with less downside risk. But its growth potential is more limited versus common stock. For long long-term investors that can stomach risk, common stock may be better for chasing bigger gains over time.

On the flip side, income-focused investors who care about consistent dividends and less risk might lean towards preferred stock. At end of day, deciding between them depends on your financial objectives, timeline and how much risk you want.

How to Invest in Preferred Stock and Common Stock

Can purchase both preferred and common stocks via broker, either online or at traditional brokerage firm. Most online brokers now offer commission-free trading for stocks, making buying and selling shares more affordable.

When investing in preferred stocks, important to research specific features and risks of each preferred stock issue before buying. Pay attention to credit ratings, dividend yield, callability, convertibility of the preferred shares. Investors can review credit ratings from agencies like Moody’s or S&P for each preferred stock offering.

Diversification crucial when investing in both preferred and common stocks. Spread investments across different companies and sectors to manage risk. One way to diversify is by investing in preferred stock ETFs or mutual funds, which provide exposure to basket of preferred shares.

Remember common vs preferred stocks have different ticker symbols, so ensure purchasing correct security. With proper research and diversification, both preferred and common stocks can play role in balanced investment portfolio.

Conclusion

In essence, common and preferred stocks have distinct traits catering to different investor needs. Common stocks provide voting rights, potential appreciation, variable dividends. Preferred stocks offer priority dividend payments, limited voting rights, lower risk.

When comparing stocks, investors must consider their goals, risk tolerance and timeline to determine suitable stock type for portfolio.

Here is a rewrite of the text following the same writing instructions:

To learn more about how companies can structure their stock offerings, check out our article on Stock Classes A, B and C. It analyzes special rights and benefits that come with different stock classes.