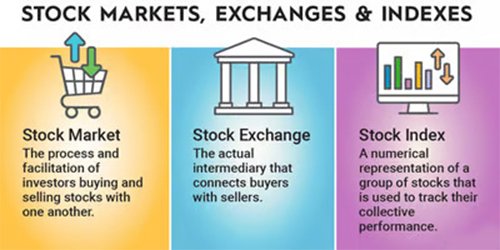

Stock market refers to places where people trade ownership shares of public companies. These shares represent part ownership in the company and give the holder a claim to a portion of the company’s assets and earnings. It’s a network of economic transactions rather than a discrete physical entity.

Main Components of Stock Market

Several key components make up the stock market and enable buying and selling shares.

Stock Exchanges

Stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq act as marketplaces for trading stocks. They ensure fair trading practices and offer a platform for price discovery.

Stock Market Indices

Indices are another big part of stock market. These statistical measures track how groups of stocks perform to give investors a snapshot of the overall market or specific sectors. Well-known examples are S&P 500 which covers 500 large U.S. firms and Dow Jones Industrial Average covering 30 major U.S. companies.

Market Participants

Different people and institutions participate in stock market activity, including investors buying and selling, traders seeking short-term profits, brokers facilitating transactions, market makers providing liquidity and investment banks assisting with stock issuance.

What are Stocks and How They Work

To really get what stock market is and how it functions, you need to understand the basic components traded there, which are stocks.

What Are Stocks?

A stock is a type of security signifying ownership in a company. It represents a claim to a piece of the company’s assets and earnings. When you purchase a stock, you effectively buy a small slice of the company and become a shareholder.

The two main kinds of stocks are: common and preferred stocks.

- Common stock lets owners vote at shareholder meetings and receive dividends if the company pays them.

- Preferred shareholders usually don’t get voting rights but have a higher claim to assets and earnings over common shareholders. If the company liquidates, preferred shareholders get money before common ones do.

How Companies Issue Stocks: Going Public with an IPO

When a private company wants to go public and issue stocks, it normally does an initial public offering (IPO). An IPO sells company shares to the public for the first time and allows investors to buy ownership.

Companies issue stocks and go public to:

- Raise money to grow

- Give liquidity to existing shareholders

- Boost public profile and credibility

IPO process means working with investment banks which act as underwriters.

Underwriters perform following tasks:

- They help set the initial share price

- They market the offering to draw investors

- And they facilitate selling the shares on stock exchange.

Once the IPO finishes and stocks trade on an exchange, the company becomes publicly traded. That requires financial reporting, disclosures and other regulatory needs. Stock market serves as a place for the company’s shares to be bought and sold, with prices moving based on supply and demand.

Shareholder Rights and Benefits: The Perks of Owning Stocks

Owning a company’s stock comes with some rights and possible benefits. As a shareholder, you can vote on big company decisions like electing board members or approving mergers and acquisitions. How much your vote matters depends on number of shares owned.

Another good thing about owning stocks is you can earn dividends. When a company earns profits, it may share some earnings with stock owners via dividends. This gives investors regular income which they can reinvest to compound returns.

Also, as the company grows, its stock value often grows too. This gives shareholders a chance to sell their stocks at higher price than they actually purchased them for. It results in capital gains.

Valuing Stocks: Determining What Shares are Worth

Calculating a stock’s value, a.k.a. stock valuation, helps investors know what company shares are really worth. This value depends on things like company earnings, growth prospects and market conditions.

One valuation approach is fundamental analysis. In this approach we examine a company’s financial statements, competitive edges, management and industry trends to estimate its intrinsic value. If market price sits below this, stock could be undervalued and a good buy.

Technical analysis is another method, using historical price and volume data patterns to predict future movements. Technicians use charts and indicators to make trading calls based on market trends and investor sentiment.

In the end, many factors influence stock value, including investor mood, psychology and the economy. Understanding different valuation techniques helps investors make informed stock decisions.

Key Terminology for Stock Market

To effectively Deal stock market, understanding key terms used by investors and traders is essential. Some fundamental order types every market participant should know are:

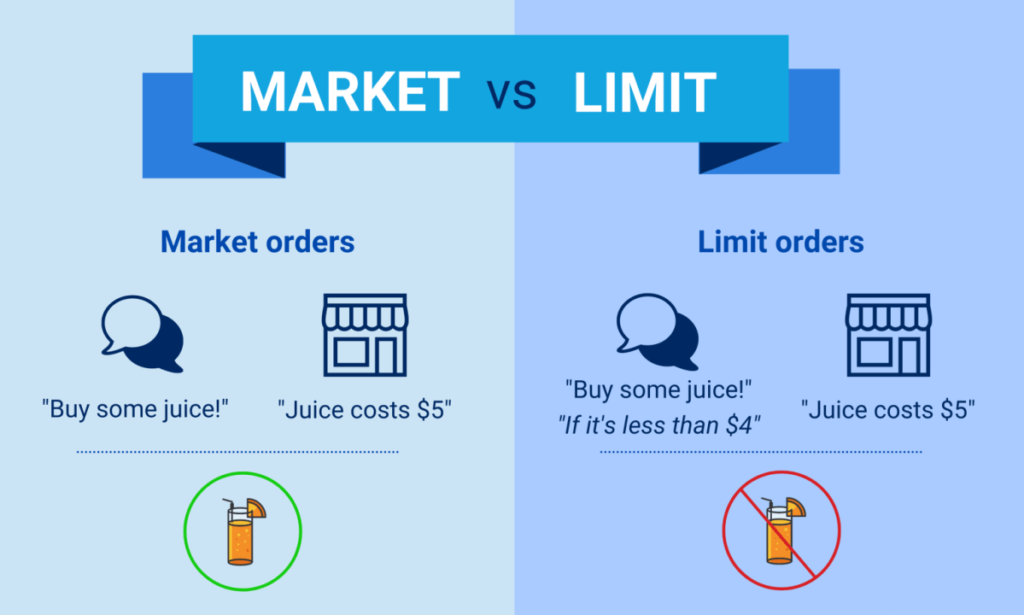

Market Orders vs Limit Orders

Market orders and limit orders are two main ways investors can buy or sell stocks. A market order trades immediately at best price available. It guarantees order will be filled but not the execution price.

In contrast, a limit order buys or sells a stock at a specific price or better. Investor specifies maximum price they’ll pay when buying or minimum price they’ll accept when selling. Limit orders control price but don’t guarantee execution, as set price may never happen.

Bid Prices and Ask Prices

Every stock has two prices – the bid price and ask price. Bid price is highest price a buyer will pay per share while ask price is lowest price a seller will take.

Difference between bid and ask prices is the bid-ask spread. A smaller spread signals a more liquid stock with lots buyers and sellers. A wider spread suggests an illiquid stock with fewer participants.

When buying a stock, you pay the ask price. When selling, you receive the bid price. Bid and ask prices constantly change based on supply and demand, reflecting the dynamic stock market.

Bull vs Bear Markets

When people talk about “bull” and “bear” markets, they’re describing what’s happening with stock prices. A bull market means prices are rising, the economy’s strong, investors are confident and optimism rules. Investors think the upward trend will keep going.

On flip side, a bear market sees falling stock prices, typically dropping 20% or more from recent highs. Bears often coincide with slower economies, higher unemployment and worries all around. Investors expect the downward slide to continue.

Historically, bull markets tend to outlast bear markets. These cycles get caused by various economic, financial, and political events.

Market Capitalization: Measuring a Company’s Size and Value

“Market capitalization” or “market cap” measures a publicly traded company’s size and value. It’s calculated by multiplying total shares outstanding by the current single share price.

Market cap is used to categorize stocks into groups:

- Mega-cap and large-cap: $10 billion plus

- Mid-cap: $2 billion to $10 billion

- Small-cap: $300 million to $2 billion

- Micro-cap and nano-cap: Under $300 million

These categories help investors gauge potential risks, returns, growth prospects and stability. Large-caps are seen as more stable and less risky while small-caps can have bigger growth potential but also more volatility.

For stock market investors, understanding market cap provides useful insight into a company’s size, value and possibilities.

Market Sentiment: Gauging Investor Attitudes and Emotions

Market sentiment refers to investors’ overall attitude toward the stock market—whether they’re feeling bullish or bearish. Sentiment gets influenced by stuff like economic data, company earnings reports, political events and news coverage. It’s a big deal in stocks because it can move supply and demand, leading to price changes.

Sentiment indicators include investor surveys, market volatility and the put-call ratio. When sentiment is upbeat, investors see blue skies ahead and expect prices to rise. But when sentiment is gloomy, investors prepare for storms and falling prices.

Understanding market sentiment can help investors make smarter choices in stocks. But sentiment can be irrational and based on emotions like fear or greed. So investors should look at sentiment along with other basic and technical analysis when deciding on moves. Relying on sentiment alone is quite risky.

Role of Stock Exchanges in the Market

Stock exchanges provide a crucial platform for buying and selling securities. They promote efficient capital allocation, transparency and fair trading practices.

Primary Functions of Stock Exchanges

Here are main functions of stock exchanges in the stock market are:

- Host trading place for investors to trade stocks, enabling good price discovery and liquidity.

- Facilitate price setting as buyer/seller interaction determines security values, reflecting market’s view of a company.

- Enforce rules to prevent fraud, manipulation and insider trading – promoting level playing field.

- Require listing companies to meet strict transparency, governance standards and protecting investors.

By doing these jobs, exchanges contribute to overall stock market efficiency, integrity and growth – fostering an environment for companies to raise capital and investors to participate.

Major Stock Exchanges Around the World

Stock market is a worldwide web of exchanges for trading securities, including:

- New York Stock Exchange (NYSE): The largest exchange globally by market value.

- NASDAQ: Second-largest exchange based in the United States, known for tech company focus.

- Japan Exchange Group (JPX): Largest Japanese exchange, major player in Asia.

- Shanghai Stock Exchange (SSE): China’s biggest, key to country’s financial markets and the global economy.

- Hong Kong Stock Exchange (HKEX): International gateway for foreign investors into Chinese companies.

Along with places like London Stock Exchange (LSE), Euronext and Shenzhen Stock Exchange, these exchanges form the backbone enabling securities trading worldwide.

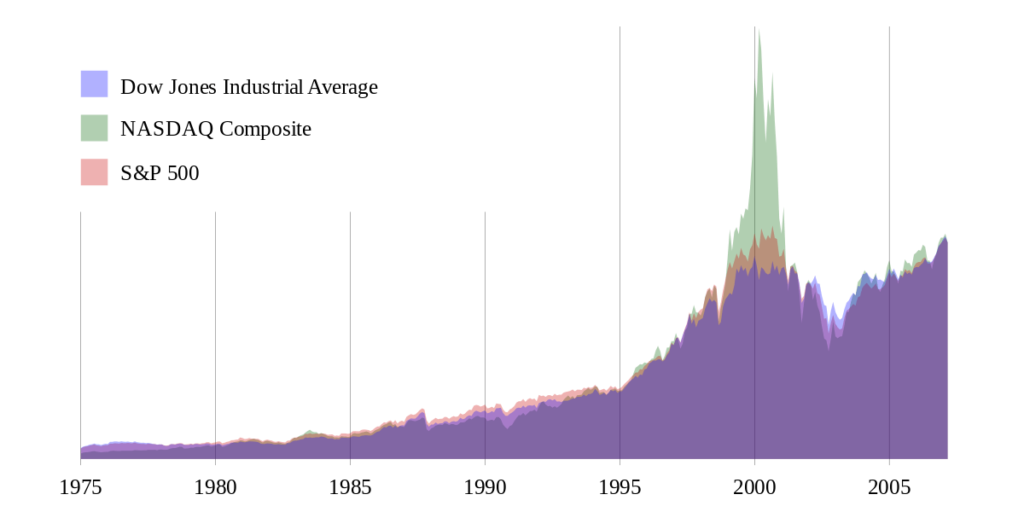

Benchmarking Performance with Stock Market Indices

Stock market indexes track groups of stocks to give snapshot of overall market or specific sectors. They provide benchmarks for investors to gauge health and compare returns.

Major indexes include:

- S&P 500: Control 500 large US companies

- Dow Jones: 30 big US firms

- NASDAQ Composite: 3,000+ tech stocks on NASDAQ exchange

- FTSE 100: Listed Top 100companieson London Stock Exchange

- Nikkei 225:Control 225 large Japanese companies on Tokyo Stock Exchange

These indexes help investors understand general market direction and sentiment – making them key analysis and decision-making tools.

Factors Influencing Stock Prices: Supply, Demand, and More

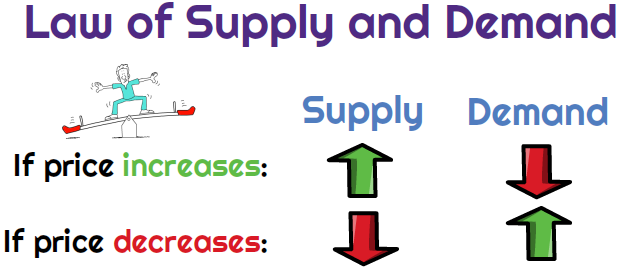

In the stock market, share prices get determined by supply and demand, just like basic economics. Understanding these forces is crucial for investors to get why market shifts and prices bounce around.

Supply and Demand: Fundamental Drivers of Stock Prices

In stocks, supply means total no of shares stockholders will sell at various prices. Demand is total number of shares potential buyers will purchase at different prices.

As a stock’s price rises, more shareholders want to sell, increasing supply. As price drops, more investors want to buy, lifting demand.

Market constantly seeks an equilibrium price where supply equals demand. Here, buying and selling is balanced and price holds steady until new factors shift supply or demand.

Company Performance and Fundamentals

A company’s financials significantly impact its stock price. Earnings reports and statements provide insights into revenue, expenses, profits and growth potential.

Key ratios like price-to-earnings (P/E), price-to-sales (P/S) and return on equity (ROE) help investors assess financial health and valuation compared to peers. Investors watch sales and profitability closely since these tie directly to cash flow and shareholder returns.

Positive earnings surprises, strong revenue growth and fatter margins can lift stock prices. Disappointments can lead to declines in stock price. Carefully analyzing financials and fundamentals is key for informed investment decisions in stock market.

Economy Factors In Stock Prices

Economic factors significantly influence stock valuations. Interest rates and monetary policy from central banks can majorly impact stocks. Lower rates typically lift demand and prices, while higher rates cool things off.

Inflation and economic growth also drive stock prices. High inflation can hurt company and consumer purchasing power, dragging down stocks. Strong economic growth like higher GDP can boost corporate earnings and share prices.

Geopolitical events like wars, trade disputes or political instability can spark market uncertainty and volatility, potentially lowering stock prices. Investors watch economic indicators and events closely to gauge impact.

Investor Behavior and Markets Sentiment

Market sentiment and how investors behave play a big role in driving stock prices, sometimes irrationally. Herd mentality can inflate bubbles and overvalue stocks as people blindly follow the crowd. Contrarian investors deliberately go against the grain, buying when others sell.

Behavioral biases like overconfidence, fear of losses and anchoring also sway investor actions and stock prices. Understanding investor psychology matters greatly in dealing the complex stock market.

History of Stocks and Markets

The stock market’s history stretches back centuries, from early origins in medieval Europe to the complex global network today. Understanding this evolution provides insights into modern finance and stocks’ economic role.

The Early Days of Stock Trading: From Ancient Rome to Medieval Europe

The idea of trading stocks traces back to ancient Rome. But the first official stock exchange opened in 1602 in Amsterdam for the Dutch East India Company.

In the late 1200s in Bruges, Belgium, commodity traders gathered at a square owned by the Van der Beurze family – later known as the “Brugse Beurse.” This concept spread across Europe as “Beurzen” popped up in Ghent, Rotterdam and elsewhere.

Italian city-states also played a big early role. Venetian bankers started trading government securities in the mid-1200s. Companies in Pisa, Verona, Genoa and Florence later followed suit, laying foundations for modern markets.

1929 Stock Market Crash and Great Depression

The 1929 stock market crash was pivotal, triggering the Great Depression. The crash began on October 24, “Black Thursday,” when stocks opened 11% lower. Panic selling ensued despite stabilization attempts, and the market kept plunging.

The crash exposed the market’s shaky foundation. The Depression brought widespread bank failures, joblessness and economic hardship. New regulations like the 1933 Securities Act aimed to prevent future crises.

Rise of Electronic Trading

The switch from old school floor trading to electronic systems kicked off in the 1970s when NASDAQ became the first all-electronic stock market in 1971. But it actually started more like an electronic bulletin board rather than straight-through processing.

Over next twenty years, electronic platforms like Globex and E-Open popped up, opening access to different financial markets. By late 1990s, most personal stock trading had gone online, although big institutional players still used proprietary electronic platforms. This rise of electronic stock trading brought down transaction costs, improved liquidity, stirred up competition and tightened spreads.

Major Stock Market Milestones and Events

The stock market’s seen some wild rides during its history:

- Black Monday (1987): Stocks crashed hard with the Dow falling to 22.6% in one single day – biggest ever one-day drop.

- Dot-com bubble and burst (1990s-2000s): Tech stocks soared then nosedived when bubble burst.

- Global Financial Crisis (2007-08): Mortgage meltdown kicked off market freefall and widespread recession.

- The Flash Crash (2010): Prices inexplicably plunged then rebounded just as quick.

- COVID crash and comeback (2020): The pandemic first tanked stocks then spurred a raging comeback.

These crazy events show the stock market’s always at risk of volatility. They highlight why long-term investment strategies matter for weathering wild milestones.

How to Start Investing in the Stock Market

To start playing the stock market, you’ll need to open a brokerage account. This account connects you to the stock exchange so you can buy and sell securities.

Open Your Brokerage Account

There are two main brokerage account types: cash accounts and margin accounts.

Cash accounts: make you fully pay for each transaction.

Margin accounts: let you borrow from the broker to buy stocks.

Opening an account requires personal details like your name, address and social security number. You’ll also fund your account with an initial deposit, typically via bank transfer or check. Once set up, start researching and investing.

Conduct Stock Market Research: Fundamental and Technical Analysis

Thorough research is crucial for smart stock picks. Fundamental analysis means looking at financials, management, competition and industry trends to gauge a company’s true value.

Technical analysis focuses on price and volume history to spot patterns and predict where prices are headed. Staying on top of market news and events that can impact stocks is also key.

Using both fundamental and technical analysis gives a more complete picture to make informed decisions. This stock market homework helps investors pick winners.

Create an Investment Strategy: Setting Goals and Managing Risk

Having a solid investing strategy matters big time for making money in stocks. First, set financial targets and figure out your appetite for risk. This helps pick asset mix and diversification plan.

Decide if you want hands on or hands off approach. Active investing means buying and selling a lot. Passive investing focuses on long term holds and less trading.

Make a roadmap aligning your goals, risk tolerance and investing style. Might be mix of index funds, individual stocks and other securities. Regularly review and rebalance portfolio to stick to your strategy.

Place Trades and Manage Your Stock Portfolio

Once brokerage account is setup and you have a gameplan, start executing stock trades. To buy or sell, place orders like market orders or limit orders.

After trading, watch portfolio performance and manage positions. Can set stop losses, rebalance portfolio or adjust holdings based on market and goals.

How the Stock Market Gets Regulated

The stock market has various regulations and oversight to ensure fair trading, protect investors, and maintain integrity.

The SEC: The Primary Regulator of the U.S. Stock Market

The Securities and Exchange Commission (SEC) primarily regulates the U.S. stock market. It enforces securities laws, watches over stock exchanges and traders and makes public companies share financial info.

The SEC aims to shield investors, keep markets fair and orderly and help companies raise money. It plays a huge role in pushing transparency and preventing fraud in the stock market.

Sarbanes-Oxley Act (SOX)

The Sarbanes-Oxley Act (SOX) got passed in 2002 after big corporate accounting scandals. It set tougher financial reporting standards for public firms, requiring them to have tight internal controls, independent auditors and executives who take responsibility for financial statements.

SOX seeks to improve accuracy and reliability of what companies disclose, protect investors, and restore confidence in the stock market. Following SOX matters a lot for publicly traded companies since not complying can lead to huge fines or even criminal charges.

Dodd-Frank Wall Street Reform

The Dodd-Frank Act got passed in 2010 following the 2008 financial crisis. It aimed to better financial stability, increase transparency and protect consumers. The Act introduced the Volcker Rule, restricting banks from risky trading and investing in hedge funds and private equity.

The Act also made the Consumer Financial Protection Bureau (CFPB). This shields consumers from abusive money practices and watches over financial products like mortgages and credit cards. Dodd-Frank has been credited with making the stock market and financial system more secure, although some critics argue it overburdens small banks.

In Conclusion

In this guide, we explored stock market basics, history, key parts and things influencing stock prices. We also talked about the importance of market rules and steps to participate in the stock market.

Getting the stock market matters for investors wanting long-term wealth. By researching thoroughly, making a sound strategy and keeping up with conditions, investors can make informed choices and handle complexities.

Remember, investing has risks, so educate yourself and get professional advice when needed. With patience, discipline and a long view, the stock market can powerfully meet financial goals.