Investing in finance markets needs a strategic technique to increase returns and reduce risks. Two main investing strategies that have been effective for a very long time are the top-down and bottom-up investment approaches. Understanding these methods is very important for investors who want to improve their portfolio management strategies.

This blog post will cover both strategies, looking at definitions, features, upsides and downsides. We’ll also compare these strategies and discuss combining them for a more complete investment approach. By the end, you’ll know which approach might best match your investment goals and style.

Top-Down Investing Method

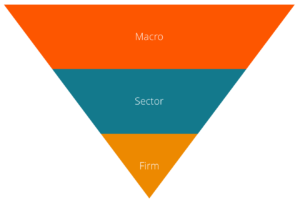

The top-down investment method is a plan that starts with a big economic perspective. It works down to specific investments. This approach focuses on macroeconomic factors and broad market trends to guide investment decisions. Investors examine industry sectors, global and domestic economic conditions and market dynamics before looking at individual companies.

Now, let’s explore characteristics, advantages, disadvantages and some of it’s examples:

Key Characteristics

Main characteristics of top down investment approach are:

- Starting point: It starts with market trends and macroeconomic factors

- Scope: Its scope is very broad and involves whole economies and sectors

- Analysis direction: From general situation to specifics

- Primary attention: Primarily it focuses on market sentiments, economic indicators and sector performance

Advantages

Top-down investing approach has some advantages which are:.

- It identifies wider market opportunities

- It’s helpful for less experienced investors to understand complex finance landscapes.

- It is useful for tactical asset allocation, letting investors adjust portfolios on the basis of shifting economic conditions.

Disadvantages

Disadvantages of top down investing approach are:

- It may overlook strong individual companies outside popular sectors.

- It’s prone to instant macroeconomic changes, invalidating previous analyses.

- Broad focus means possibly missing detailed individual company’s examinations.

Examples

General top-down approach usage incorporates sector rotation on the basis of business cycles and investing in global tech ETFs during a technology boom. These techniques use big economic trends to make right investment decisions.

While comparing top-down vs. bottom-up approaches, investors should consider their time commitments, investment goals and personal skills.

Bottom-Up Investment Method

The bottom-up investment approach starts by studying the basics of individual companies, instead of focusing on broad market trends and macroeconomic issues. This method includes closely examining a company’s competitive edges, growth potential, financial health and management quality to find undervalued investment chances.

Let’s talk about some characteristics, pros, cons and examples of bottom up investment approach:

Key Characteristics

Major characteristics of bottom up investment approach are:

- Starting Point: Analysis starts at company-level, studying certain financial tools and business operations.

- Scope: Its scope is narrow and targets individual companies rather than sectors or the whole economy.

- Direction of analysis: This approach goes from micro (single companies) to macro (industry and economic context).

- Primary Focus: Core focus is company attributes like debt levels, management competence, earnings and revenue growth.

Pros

Pros of bottom up investment approach are given below, it:

- targets individual companies, investors can find high-potential investments overlooked in broader market analysis.

- allows comprehensive grasp of a company’s business model and financial health that gives a strong base for making long-term investment decisions.

- focuses on company basics, less affected by macroeconomic changes and short-term market shifts.

Cons

Bottom up investment approach also has some cons which are:

- Thorough research on each company requires significant time and effort, so it’s less suitable for investors with limited resources.

- Investors might miss broader economic or industry trends that could affect a company’s performance by focusing on just specific details of a company.

- This approach requires a high financial analysis experience and deep understanding of an industry in which a company is working..

Examples

Examples of bottom up investment approaches are:

- Finding Small-Cap Companies with High Growth Potential: Investors Identify a small-cap company with strong financials, high growth potential and innovatory products.

- Analyzing Financial Statements In-Depth: For example an investor might assess a cash flow, balance sheet and income statement of a company to evaluate its liquidity, financial health and profitability.

By focusing on the micro-level details of individual companies, the bottom-up investment approach gives a basic perspective that can reveal unique investment chances. This makes it an important technique for critical investors.

Comparison: Top-Down vs Bottom-Up Investment Approaches

To understand the difference between the top-down and bottom-up investment approaches, it’s very important to compare their characteristics, advantages and disadvantages.

Differences

A table showing differences between top down and bottom up approaches is given below:

| Aspect | Top-Down Approach | Bottom-Up Approach |

| Starting Point | Macroeconomic factors and broad market trends | Individual companies and their fundamentals |

| Scope | Broad and wide, focusing on sectors and economies | Narrow and deep, focusing on individual stocks |

| Direction of Analysis | From macro to micro (economy top sectors to companies) | From micro to macro (companies to sectors to economy) |

| Primary Focus | Economic indicators, global trends, sector performance | Company-specific metrics, financial statements |

| Investment Decisions | Based on economic outlook and sector potential | Based on detailed analysis of company performance |

Which Approach is Best to Choose?

Investor’s abilities, goals and market conditions are very helpful in deciding between top-down and bottom-up investing approaches. The top-down investment approach is suitable for investors who want to take advantage of macroeconomic trends and choose a broader market perspective. On the other hand, a bottom-up investment strategy is good if you can analyze individual companies, seeking for undervalued stocks with growth potential.

Combining Both Approaches

Many successful investors use both strategies to make a strong portfolio. Investors utilize the strengths of both approaches by using top-down analysis to find promising sectors and bottom-up analysis to pick the best companies within those sectors. This hybrid strategy gives a more complete market understanding. It also lowers risk and improves potential for higher returns.

By blending both strategies, investors can create a versatile investment portfolio that’s appropriate for different market conditions.

In Conclusion

Understanding both top-down and bottom-up investment methods is very important for an investor seeking to form a strong portfolio. Each strategy has unique benefits and proves powerful when utilized correctly. While the top-down investment approach looks at big economic trends, the bottom-up investing approach evaluates individual companies. The best approach depends on your investment experience and goals.. However, combining both techniques leads to a more balanced and powerful strategy. By assessing macroeconomic factors and company details, you can potentially increase your investment returns and make right decisions. Keep in mind, smart investing means using the right tools for your situation and objectives.

To further improve your investment plan, read our post on “Key Qualitative Factors When Evaluating Stocks” to learn about the human aspects that can make or break a stock’s performance.