Renewable energy regulations have become very important as the use of clean energy increases. These policies give financial advantages and establish particular guidelines which handle the response of a market towards green transitions. In this blog post, we will talk about affect of renewable energy policies on the growth and value of stocks.

Overview of Renewable Energy Regulations

Policies and laws which manage clean energy sources are renewable energy regulations. These rules provide clear frameworks to increase clean energy production. They also protect interests of both private and public sector in renewable energy market.

Types of Renewable Energy Regulations

Regulators implement two types of policies which are quantity or price based. Quantity based regulations set explicit targets for production and use of renewable energy whereas price based regulations set particular prices of renewable energy.

Main Instruments of a Policy

Feed in Tariffs (FITs): These instruments guarantee particular prices to renewable energy producers for their electricity generation. Long term price-guarantees help companies make better investment decisions.

Renewable Portfolio Standards (RPS): Utilities must obtain predetermined percentages of energy from renewable sources under RPS. These standards stimulate market growth by generating a continuous need for clean energy.

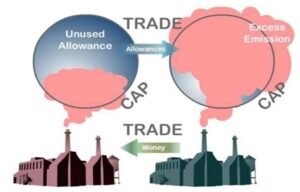

Carbon cap and trade programs: They enforce limits on carbon emission. Companies can trade emission permits within these limits. This system supports clean energy adoption and provides a carbon pricing mechanism.

Subsidies and tax credits: These programs decrease renewable energy project costs. Such financial incentives help renewable energy compete with fossil fuels.

How Regulations Affect Stock Market

Stock market investors face both difficulties and opportunities from renewable energy regulations. These policies affect three main areas which are investment decisions, trading patterns and market returns.

Impact on Investment Decisions

Environmental and climate policies decrease capital costs for renewable projects. Companies access loans at lower rates when policies support clean energy. This provides better investment opportunities for both investors and companies.

But Policy uncertainty can decrease investment confidence. Frequent policy changes force investors to demand greater returns. Companies usually cancel or delay renewable projects when regulations lack clarity.

Market Reactions and Abnormal Returns

Climate policy announcements trigger immediate reactions in stock markets. These reactions give unusual returns for renewable energy stocks in short term.

While market shows more favorable responses over longer periods. Investors develop a more positive outlook toward renewable energy stocks as supportive policies strengthen the sector. This positive sentiment translates into better stock performance for extended time frames.

Trading Volume and Liquidity Effects

New policy announcements in renewable energy increase trading activity. This increase in trading volume shows investor’s attention to the sector. The level of trading activity serves as a main indicator of changes in investor sentiment.

Stock price stability is based on liquidity levels. Stocks with greater liquidity show less volatility during regulatory changes. This stability benefits renewable energy companies when policy changes occur.

Major Policy Mechanisms and Their Stock Market Outcomes

Stock market performance in the renewable energy sector responds directly to policy decisions. We will examine particular policies and their effects on investor decisions and stock prices.

Feed in Tariffs (FITs)

FIT systems guarantee renewable energy producers a fixed price for their electricity production. These prices exceed standard market rates for old energy sources. The price guarantee remains for 15-20 years. This extended commitment minimizes risks for investors.

Observed Market Reactions

FIT announcements make remarkable impacts on renewable energy stocks. Data shows a -0.16% average abnormal return on announcement days. The cumulative effect reaches -0.83% over an 18 day period. Beside these initial negative reactions, FITs benefit companies in the long term through reliable revenue streams.

Carbon Cap and Trade

A cap and trade system sets particular carbon emission limits. Companies operate within this system. Some businesses decrease their emissions below the required cap and earn profits through permit sales. Whereas other companies exceed their limits and purchase additional permits.

Correlations with Stock Performance

Stock prices respond in a different way to cap and trade policies based on the type of a company. High emission companies face increased operational costs and it generally decreases their stock values. Clean energy companies usually take advantage of max stock price as investors anticipate their expanded market presence.

Tax Incentives and Subsidies

Renewable energy projects require substantial investment. Tax incentives and government subsidies decrease these financial barriers. These support mechanisms lower both ongoing operational expenses and original setup costs. This makes renewable energy more price competitive in the energy market. U.S government currently provides a 30% tax credit on total solar installation costs.

The temporary nature of these policies causes market difficulties. Stock volatility increases as policy expiration dates approach. Investors struggle to predict future earnings without certainty about continued support. This uncertainty frequently triggers considerable declines in stock price.

Regulatory Uncertainty

Changes in renewable energy regulations cause investment risks. New tax implementations and policy changes affect the confidence of an investor. Most companies struggle with long term planning under changing conditions. These factors decrease available capital for renewable energy initiatives.

Regulatory ambiguity increases project financing costs. Due to the changing rules investors need greater returns to manage the risks. This additional risk premium raises project costs and increased expenses slows down the growth of renewable energy industry. The renewable energy sector demands clear and stable policies to maintain reasonable costs and attract investments.

Investors’ Perspective on Policy Driven Market Volatility

Stock market responds directly to renewable energy regulations. These policies provide investment opportunities while presenting particular risks. Successful investors must analyze these policy affects to make right investment decisions:

Short Term Strategy

Investors need to stay informed about new renewable energy policies. Quick changes in rules can cause sudden changes in stock prices. To protect against these difficulties many investors use hedging strategies such as using financial derivatives or different energy types.

Long Term Strategy

Geographic diversification is a necessary long term investment technique. Different countries implement varied renewable energy policies. This variation helps investors balance their exposure to policy risks. A change in one country’s regulations will not severely impact a geographically diverse portfolio.

ESG metrics now work as necessary tools for investment decisions. These measurements help investors find companies with strong environmental compliance. Such companies usually show better resilience under new environmental regulations.

Difficulties and Criticisms

The market impact and performance of renewable energy regulations face many serious difficulties, despite their goal to increase clean energy adoption.

Policy Efficacy and Self Selection Bias

Renewable energy policies provide an imbalanced market advantage. Most companies that have sustainability practices get maximum benefits from these policies. New market entrants struggle to compete with these established early adopters.

Subsidy Dependence

Government support remains necessary for the competitiveness of renewable energy sector. This continuous need for subsidies causes serious concerns about the market’s ability to keep itself independent.

Social and Environmental Trade Offs

Relationship between financial realities and climate objectives presents many difficulties. The research presents a positive effect of renewables on wholesale electricity prices during peak periods of production.

But this benefit comes with additional costs because the power grid requires new distribution and transmission infrastructure to accommodate renewable energy sources. These additional infrastructure costs along with policy adjustments provide two competing priorities which are making sure of affordable electricity access and maintaining public support.

To Sum Up

Policy decisions in renewable energy industry directly affect stock market performance within the clean energy sector. These regulations impact three main areas which are capital expenses, investor confidence and the long term profit potential of renewable energy companies.

Stock values can increase with strong regulatory support. But, policy uncertainties mostly cause market instability. Success in this changing market requires investors to manage their strategies accordingly and keep in mind constant awareness of policy developments.