Renewable energy stocks are becoming increasingly important in today’s market. This shift reflects the world’s move towards sustainable power sources. These stocks represent companies that focus on clean energy sources, such as wind, solar and hydropower. Investing in renewable energy stocks allows you to support environmental initiatives while possibly gaining financial rewards. Today we will see how you can determine that certain renewable energy stocks are worth investing in or not.

Key Metrics for Analyzing Renewable Energy Stocks

To analyze renewable energy stocks successfully, investors must grasp key metrics. These metrics give valuable insights into a company’s potential and performance. Let’s take a look at some necessary financial performance metrics for assessing renewable energy stocks.

Financial Performance Metrics:

Return on Investment (ROI)

ROI demonstrates how successfully a company uses its investments to generate profits. Companies with higher ROIs usually perform better in the market. For businesses in the renewable energy sector, ROI shows the success rate of their clean energy initiatives.

Levelized Cost of Energy (LCOE)

LCOE permits investors to compare different energy generation methods objectively. This metric calculates the average cost of electricity production over a power plant’s complete lifespan. By using LCOE, you can determine which renewable energy sources give the most cost-saving solutions. Generally, a lower LCOE indicates a more competitive energy source in the market.

Energy Payback Time

This metric assesses the duration required for an energy system to produce an amount of energy identical to that used in its creation. Energy payback time is very important for evaluating the long-term viability of renewable energy technologies. Shorter payback periods suggest more sustainable and proficient systems which make them more attractive to investors.

Operational Performance Metrics:

Capacity Utilization Rate (CUR)

CUR gives insight into how proficiently a company uses its production capacity. To calculate CUR, divide the actual output by the maximum possible output. A high CUR (generally above 80% for renewable energy companies) shows good asset utilization. This metric helps you determine how well a company maximizes its available resources.

Load Factor

The load factor shows how stable a power plant operation is at full capacity. It’s calculated by dividing the actual energy produced by the energy that would have been produced by the plant at full capacity. A higher load factor signals more proficient operations. Wind farms usually have load factors of 30-40%, while for solar plants the average load factor is 15-20%.

Investment and Market Indicators:

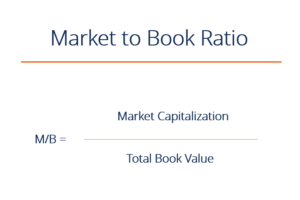

Market-to-Book Ratio Change

Market-to-book ratio divides a company’s market value by its book value. If this ratio is increasing, it means the company has potential for growth or vice versa. By examining this indicator, you can get insights about the market perception of company and its growth prospects.

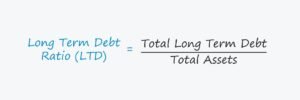

Long-Term Debt Change

Monitoring changes in long-term debt is very important for assessing a company’s financial health. Renewable energy firms usually carry some debt due to high initial costs. But too much debt can be a problem. So it is necessary to compare your company’s debt levels to industry average levels.

Social and Environmental Metrics:

Carbon Reduction Value

Carbon reduction value tells how much a company reduces greenhouse gas emissions. To calculate it, compare emissions before and after implementing renewable energy projects. Companies can transform these reductions into carbon credits which they can sell or use to offset their own emissions. This metric helps you evaluate a company’s environmental impact and potential for generating additional revenue through carbon trading.

Energy Storage Capacity

A company’s ability to store energy for later use is measured in megawatt-hours (MWh). This capacity is very important for meeting energy demand during low production periods. Higher storage capacity indicates better preparedness for fluctuations in energy demand and production. When assessing renewable energy stocks, consider this metric to understand a company’s capability to give a stable energy supply.

Analytical Tools and Advanced Indicators

The prediction of renewable energy stock prices now involves sophisticated machine learning methods such as random forests. These modern tools analyze economic policy uncertainty and market volatility to generate forecasts.

For assessing stock performance, investors depend on market models like 5-Factor models and the Fama-French 3-Factor. In many markets, the 5-Factor model usually provides a more all-inclusive explanation of stock returns in comparison with its 3-Factor counterpart. When applied to renewable energy stocks, these models take into account different variables: company size, market returns, profitability, investment patterns and value.

While these high-tech tools give valuable insights for making informed decisions about renewable energy stocks, it’s very important to remember their limitations. No prediction method is flawless and market conditions can shift rapidly.

Practical Steps for Investors to Analyze Renewable Stocks

After exploring key metrics and advanced tools, let’s see how investors can successfully evaluate renewable energy stocks.

Data Collection and Analysis

Sources of Data for Metrics

Accurate assessment of renewable energy stocks requires reliable data. The U.S. Energy Information Administration (EIA) is a primary resource of data as it provides detailed information on different renewable energy sources. This data includes production and consumption statistics. Utility records give very important details about energy generation and distribution. Additionally, industry publications and company financial reports give necessary data for thorough stock analysis.

Performance Tracking

Proficient monitoring of renewable energy stocks demands a systematic approach to tracking key metrics. You should create a framework for regular data collection and analysis. Tools like LOOXY by Scoop can simplify this process by facilitating the creation of custom dashboards and reports. These characteristics aid in easier interpretation and visualization of data. With real-time updates, you’ll always have access to the most current information which permits timely investment decisions in the renewable energy sector.

Make Calculated Investment Decisions:

After gathering and examining data, it’s very important to make pre calculated investment choices. You should:

Balance Environmental and Financial Goals

When you are investing in renewable energy stocks try to keep a proper balance between environmental and financial objectives. And for achieving both sustainability and profitability goals, focus on companies that make good contributions to environmental sustainability and have shown strong financial performance in past years.

Manage Risk and Diversify Investment

Diversification is very important to manage risk in the renewable energy sector. You should diversify your investment in different renewable stocks like solar, hydroelectric, wind etc. This strategy will help you to eliminate such ricks which are caused by some specific market factors.

Apart from this we should not ignore the importance of geographical diversification as it helps us in reducing the regional risk. Mutual funds and renewable energy ETFs allow us to fully diversify our assets and can be a great addition to our portfolio. You can also mix traditional stocks along with renewable stocks to balance your investments.

Since the field of renewable energy is constantly changing, we should keep reviewing our portfolio and make changes in our investments based on new information and changes in the market. Remember that no investment is completely risk-free, so good risk management is very important.

Conclusion

In short, it is important to know about key indicators and metrics if you want to find that a certain renewable stock is worth investing in or not. Use advanced AI tools and try to stay up-to-date about stock market to pick better stocks and make profit.