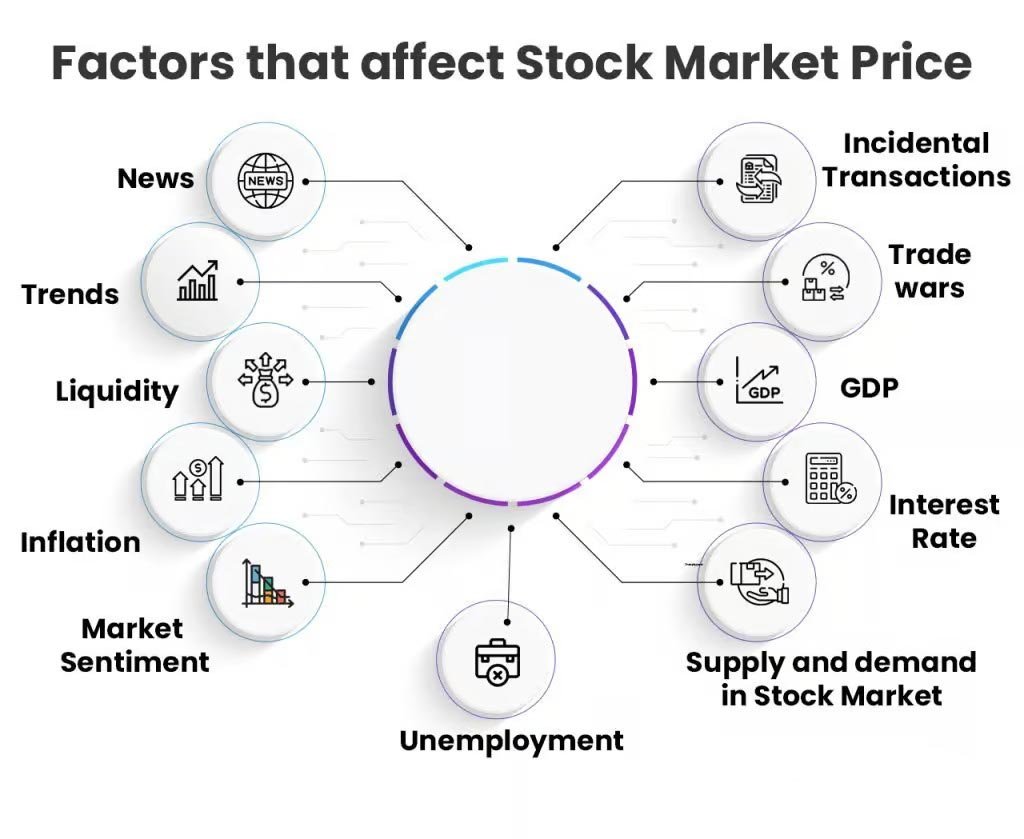

The stock market lets buyers and sellers trade shares of public companies.” The stock market has a rich history dating back centuries. Stock prices are super important because they show what people think a company’s worth is, which also decides returns for investors. To make good investing choices, you need to know what makes stock prices to fluctuate.

This article explores the big factors that determine stock prices – fundamental and technical factors, supply and demand changes and overall market sentiment. Towards the end, you’ll learn how the key elements fit together to make stock prices fluctuate and how to deal with the tricky stock market.

Fundamental Factors Influencing Stock Prices

What makes a stock price move starts with looking at stuff about the company’s real value and bigger economic picture. These fundamental factors give an idea of how the company is doing and its future growth potential. Some factors are discussed here:

Economy and Interest Rates

How things are going overall with the economy also moves stock prices a lot. Good signs like strong GDP growth and low unemployment tend to lift stocks since that points to more consumer spending and company profits. But bad signs like high inflation or the economy shrinking can cause a fall in stock prices.

Central bank interest rate policies also have big impact. Lower rates normally push stock prices up because it’s cheaper for companies to borrow and invest. But higher rates can drag down stocks since borrowing gets more expensive, potentially slowing growth.

Company News and Events

Of course news about a specific company can really swing its stock price. Good news like a successful merger or strong earnings makes the stock go up. Bad news though like scandals, lawsuits or disappointing results causes the price to crash hard. Changes in regulations in an industry also shape what investors think and how they value stocks.

Industry Performance

How an industry overall is doing can move individual company stock prices too. If an industry has strong growth in the future, stocks of companies in that industry are likely to go up. But bad industry news might cause a damage even to other companies in the same industry because investors worry about associated risks.

Also if a competitor has problems meeting demand, companies can benefit from picking up that extra business, pushing their stock prices up.

Profits and Earnings

A major thing is the company’s profits and earnings per share (EPS) which means how much net income splits across total shares. Strong earnings and profits indicate a healthy company, driving demand and prices higher. But if earnings are not good or profits drop, investors get worried and the stock price rises.

Technical Factors

Along with fundamentals, technical analysis is also very important to figure out what causes stock prices to fluctuate. Technical analysts study historical price data and trading patterns to predict where prices could go next and find good trade entry/exit points.

- Price Patterns and Trends

- Analysts check stock price charts to spot shapes and trends that may show where price is headed. Common chart patterns are head and shoulders, cup and handle, triangles and flags. Recognizing these can help predict if prices will breakout, reverse or continue recent trends.

- Trend analysis is important as well. Tools like trendlines, moving averages and support/resistance levels show the direction and strength of price trends. Uptrends make higher highs and lows, downtrends make lower highs and lows.

- Market Volume and Momentum

- Trading volume provides useful insights into how much interest or conviction is behind price shifts. High volume on price rises often means strong buyer interest and trend continuation. Low volume on falls frequently signals a lack of selling pressure and possible trend change.

- Momentum indicators like RSI and MACD gauge the speed and strength of price movements. They help spot overbought/oversold conditions and divergences between price and momentum, which can indicate upcoming trend turns.

By blending together analysis of price patterns, market volume and momentum, technicians aim to predict short-term price movements and make smart trades based on historical data. But it’s important to also consider fundamentals to fully understand the forces that affect stock prices.

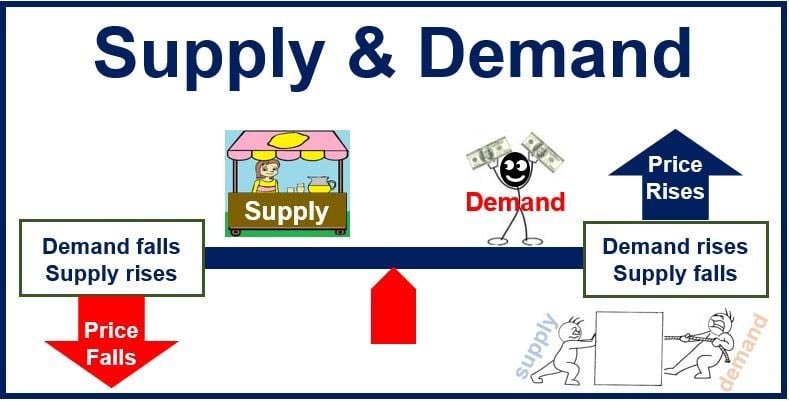

How Supply and Demand Set Stock Prices

The fundamental economic principle of supply and demand is central to determining stock prices. The interaction of buyers and sellers in the market determines the price at which stocks are traded.

- Supply and Demand Basics

- When demand is higher than supply, prices tend to rise since buyers compete for the limited shares available. But when supply outstrips demand, prices typically drop as sellers undercut each other to attract buyers.

- Market makers are key to facilitating trades and setting prices. They provide liquidity by always standing ready to buy or sell shares at the quoted bid and ask prices. The difference between the bid and ask (known as spread) is their potential profit and cost of liquidity for investors.

- Externally Influencing Supply and Demand

- Big picture events like geopolitical crises, economic recessions, or market-wide trends can impact individual stock supply/demand. For example, a recession could spur selling and dampen demand, dragging prices down.

- Large institutional investors like pension funds and hedge funds also influence prices a lot since they trade huge volumes. Their buying and selling can shift supply/demand balances, which will move prices. And other investors sometimes follow their behaviors, amplifying the price impact.

Investors trying to make their way through the confusing world of stock pricing must comprehend the complex dance between supply and demand. By tracking changes in these fundamental forces and the factors that influence them, investors can gain valuable insights into the future direction of stock prices and make better investment decisions.

Initial Public Offerings (IPOs) and Stock Price Determination

When a company first sells shares to the public in an IPO, investment firms examine its finances to set an initial stock price. They analyze past earnings, current market conditions and expected future profits to determine the value.

During the IPO, traders and investors also assess the company using financial metrics to place bids that cause the price up or down. The opening price on the first trading day gets set through price discovery – stock exchanges look at all the buy/sell orders coming in to pick a price allowing the most trades.

It’s important to note that the IPO price doesn’t necessarily show the stock’s long term value. Broader market interest and post-IPO performance often shift the price over time.

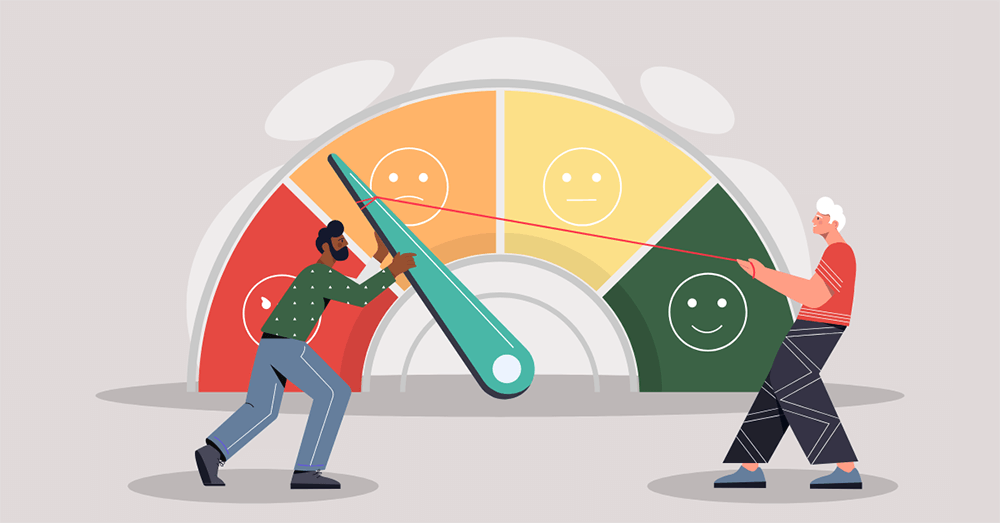

Market Sentiment

Market sentiment, which reflects investors’ overall moods and emotions, is an important factor in determining stock prices. Investor psychology can push prices around in ways not explained by fundamentals.

- Investor Biases

- Investor sentiment is frequently subjective, biased, and can persist in the face of conflicting information. Behavioral finance looks at how psychological aspects move investment choices and markets. According to studies, investors may overemphasize easily accessible data, react more strongly to losses than gains, and continue to believe incorrect information.

- Sentiment classified as bullish (optimistic) or bearish (pessimistic), with bullish tied to rising and bearish to falling prices.

- Media Influence

- News, social media, analyst reports heavily effect investor sentiment and stock prices. Positive media coverage can spur demand and price increases, while negative media coverage can prompt selloffs and declines.

- Tone and volume of media attention can amplify market reactions, sometimes creating herd behavior among investors.

Regulations and Institutions Influence Stocks

Government rules and wealthy investors also impact how stock prices get set. Laws, policies and regulators shape markets, while huge institutions like hedge funds can increase prices based on their trades.

- Government and Regulators

- Agencies like the SEC establish guidelines for fair trading and protecting investors. Their regulations can influence market sentiment and prices.

- Fiscal policies on things like taxes and spending also influence stocks based on how they change economic conditions and investor expectations.

- Big Institutional Investors

- Large institutional investors, such as pension funds, mutual funds, and hedge funds, can have a significant impact on stock prices because of the large volumes of shares they trade. Their investment decisions and trading strategies have the potential to create supply and demand imbalances, resulting in market price movements.

- They often use complex models to decide trades, further shifting how prices get determined.

So the combo of regulations and huge institutional investor actions contributes to the tricky nature of price setting in modern markets.

Conclusion

To summarize, understanding how stock prices are determined involves a wide range of factors, including fundamental analysis, technical indicators, supply and demand dynamics, market sentiment, and regulatory influences. Considering these gives investors valuable insights into the intricate world of pricing and smart investment decisions.

But no single factor fully explains or predicts price shifts. Successful investing takes broad perspectives, accounting for the various forces in the market.